5 Facts About Common Retirement Accounts 2021

Choosing the best retirement account can be difficult, knowing how much is at stake. In turn, the Trust Company Oklahoma wants to ensure you have the knowledge necessary to choose the right retirement account for you.

Before we dive into telling you 5 facts about common retirement accounts, we must define a few terms so that you can better understand which retirement account will best benefit you and your long-term goals. Please note, all definitions below come directly from the Internal Revenue Service.

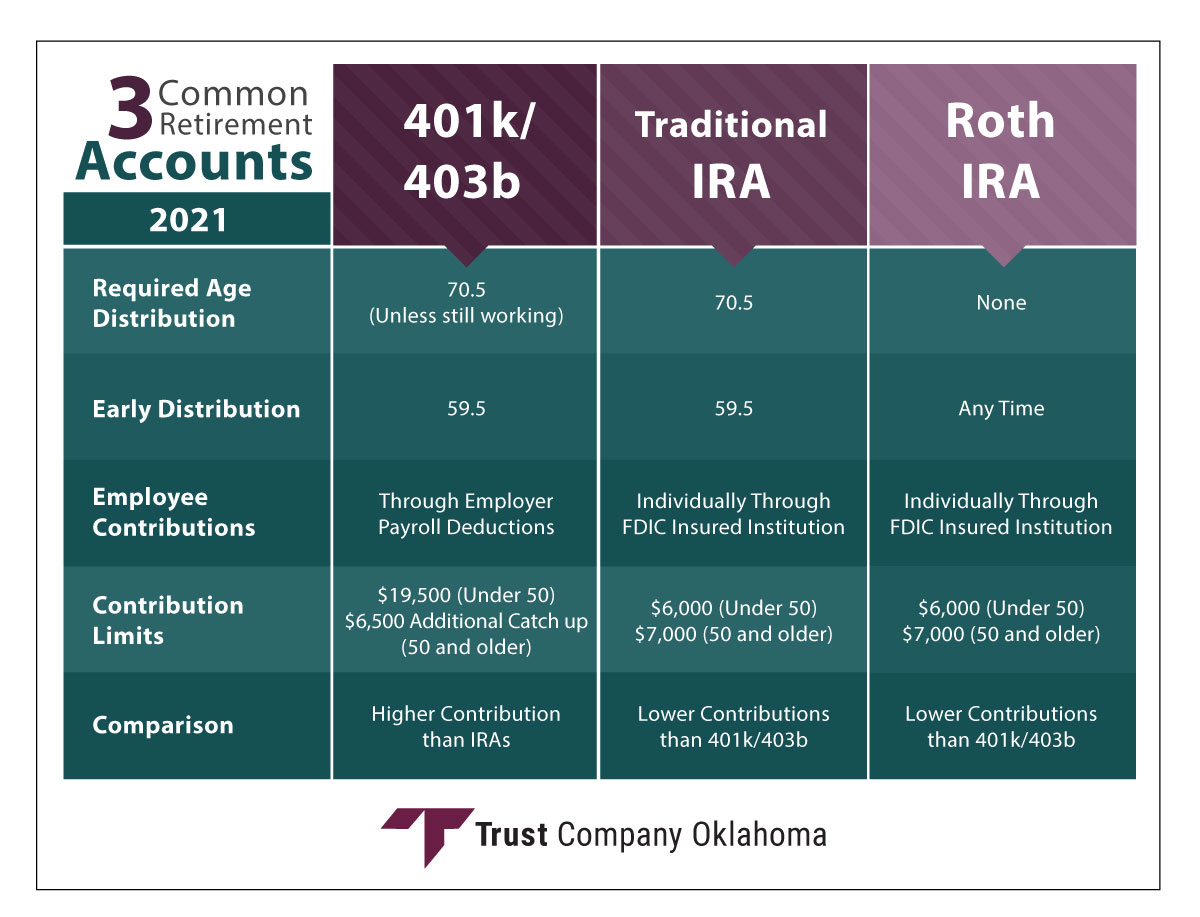

- Required Distribution Age – are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 70 ½. If your retirement account has a required distribution age and you do not start receiving minimum distributions, you will face penalties.

- Early Distribution – the amounts an individual withdraws from an IRA or retirement plan before reaching the age of 59 ½ are considered “early” distributions, which can mean the individual is subject to a 10% early withdrawal fee.

- Employee Contributions – this defines how your money gets into your retirement account.

- Contribution Limits – every retirement plan has annual limits that a participant cannot exceed.

401K/403b

401k plans and 403b plans are the most common retirement accounts that we see our clients have invested in. This is because they are given to employees in organizations. Investopedia defines a 401K plan as a tax-advantaged account that is offered to employees by their employers. A 403b is a retirement account designed for individuals who work for a non-profit or tax-exempt organization.

-

Required Distribution Age

No matter the situation, money cannot stay in a retirement account forever. In most cases, you are required to at least take minimum distributions from your 401k or 403b after you reach 70 ½ years of age. This is also the age in which you are required to pay income tax on your retirement income. However, if you are still working at 70 ½, you are not required by the government to take withdrawals from your retirement accounts.

-

Early Distribution

Though you are required to accept minimum distributions at the age of 70 1/2, you can begin taking distributions as early as 59 ½ penalty-free. Just remember, taxes will be taken on your money at that time, no matter if you are 59 or 70.

-

Employee Contributions

401k or 403b contributions are made through employer payroll deductions, and a percentage of your contribution is usually matched by your company. This employer contribution can make a huge difference to your retirement account as it is essentially FREE MONEY.

-

Contribution Limits

The current contribution limits in 2021 allow for $19,500 to be contributed should you be under 50 and an additional $6,500 should you be over 50 years old. Please know that this threshold is adjusted annually for inflation.

-

Comparison

These retirement accounts are similar to one another in that they have contribution limits and early withdrawal penalties that are set in place. The main difference between a 401K/403b and a traditional IRA or Roth IRA is that 401Ks allow for higher contribution limits.

Traditional IRA

A Traditional IRA (individual retirement account) is the term for a regular IRA available to those under age 70 ½ who have earned income. When money is placed in a traditional IRA, it is grown tax-deferred until a withdrawal takes place. What that means to you is that you can make contributions that allow for a larger paycheck currently, as your taxes will be removed with withdrawal takes place.

-

Required Distribution Age

At the age of 70 1/2, withdrawals must begin to be taken and thus taxed. The IRS provides you with several choices for calculating the minimum amount you must take from an IRA, and should you have several Traditional IRA’s, the minimum must be taken from all of them by the age of 70 1/2.

-

Early Distribution

Traditional IRAs allow you to withdraw money from your retirement account at any point, but that can mean penalties can occur. The earliest you can begin taking distributions without worrying about penalties is 59 ½. However, you need to know that you will be required to pay taxes on your money should you begin taking withdrawals at that point in time.

-

Employee Contributions

Contributions to a Traditional IRA are made individually through an FDIC Insured Institution.

-

Contribution Limits

Unlike with a 401k, there are no income limits on contributions. What that means for you is that you are able to make contributions to your retirement account no matter how much money you make annually.

On an annual basis, you may contribute $6,000 should you be under 50 and $7,000 if you are older than 50.

-

Comparison

One of the reasons people choose a Traditional IRA is that it allows for you to invest pre-tax dollars, which means that the contributions that are made are a tax deduction currently. Traditional IRA’s have lower contribution limits than that of a 401k/403b.

Roth IRA

Roth IRAs provide individuals with an opportunity to pay taxes on their contribution as they save for retirement, as opposing to differing those fees to pay later. This allows for a Roth IRA to be an effective transfer of wealth to the next generation. In a previous post, “As an example, you choose to contribute $10,000 to your 401K this year on a Roth basis. You will pay taxes on the $10,000 since you are not receiving a current tax deduction for the contribution. After 30 years of growth, let’s say your balance is now $35,000, $10,000 of your original contribution plus $25,000 in earnings. Your entire balance is tax-free, even the earnings.” Let’s further break that down for you.

-

Required Distribution Age

There is no required distribution age when it comes to a Roth IRA.

-

Early Distribution

Since there is no required distribution age, there is also not a set early distribution age either. Early Distribution for a Roth IRA can take place at any time.

-

Employee Contributions

Contributions to a Roth IRA are made individually through an FDIC Insured Institution.

-

Contribution Limits

One of the more significant requirements of a Roth IRA is that you cannot contribute to a Roth IRA if you make too much money. For example, if you are a married couple with an adjusted gross income higher than $194,000, you cannot contribute.

On an annual basis, you may contribute $6,000 should you be under 50 and $7,000 if you are older than 50.

-

Comparison

Roth IRA’s have lower contribution limits than that of a 401k/403b.

Retirement planning can be tough, especially with all the careful planning that is involved. If you need assistance in ensuring that you will be financially independent after you retire, you need to get a clear picture of your financial situation and plan accordingly. Our professionals have the experience and expertise to assist you in your retirement planning. Contact us today to get started!