Predictably Unpredictable

By James F. Arens II

What a predictable year it’s been. Who didn’t expect oil to go below $28 and then close the year near $50? Or, if predicting the price of oil isn’t your talent, at least it was easy to predict the two big votes of the year: Brexit and the U.S. presidential election.

Okay, those events weren’t so predictable.

Maybe the stock and bond markets would have been easier to predict. Remember all of the experts who said that the market would tumble if Trump were elected president? Yet, stocks have rallied 5% since Election Day. Remember the talking heads also told us that higher interest rates would be bad for stock prices? Well the 10-year U.S. Treasury yield has jumped from 1.8 to 2.4% while the stock market has continued to rally strongly.

In short, it’s been an unpredictable year. Let’s take a look at the current state of the market and the economy.

Higher Interest Rates, The Dollar and Stocks

As already mentioned, interest rates have increased significantly in the final two months of the year. Higher interest rates typically result from higher growth and/or higher inflation expectations. By looking at changes in interest rates since the election, investors can estimate that the market has increased its GDP economic growth expectations by half a percent and its inflation expectations by a quarter of a percent.

The higher economic growth expectations are based on the possibility of lower corporate and personal income taxes, increased infrastructure spending and decreased regulations. It makes sense that if the U.S. lowers corporate taxes and gives consumers more money to spend, businesses should be worth more. This helps to explain the year-end rally in stocks as the market clearly believes the improving profitability scenario.

The market also believes the baton is officially being passed from monetary policy (low interest rates) to fiscal policy (lower taxes and increased infrastructure spending). Interestingly, this transfer of power is what the Fed has been suggesting for several years as it realized there were limits to what monetary policy could do. As a result, investors will be monitoring the effectiveness of our fiscal policy initiatives (lower taxes and increased spending) in the next few years.

Of course, this doesn’t mean that we can ignore monetary policy. As was widely reported, the Fed raised the Fed funds rate in December – one year after its initial rate increase. Similar to last December, the Fed signaled it will continue raising rates in the upcoming year. The big difference this year, however, is that the market believes the Fed will actually raise rates several times. We can see this by looking at the recent increase in the two-year Treasury yield since the election, from 0.8% to 1.2%.

The Fed’s Challenge

If everyone agrees that something is about to happen, we should probably ask what could stop this from occurring. In our opinion, it’s quite possible the strengthening dollar will be the biggest hindrance to the Fed’s goal of raising rates in the future. Higher interest rates, particularly while Japan and Europe have low interest rates, have resulted in an appreciating dollar. A more valuable dollar makes it harder for American companies to export products at higher prices and makes cheaper imports more competitive with our domestically-produced goods. This competitive pressure, could in turn, pressure the Fed to proceed more slowly on further rate increases. Dallas Fed President Robert S. Kaplan has frequently mentioned this idea, noting that almost 50% of S&P 500 earnings originate outside the US.

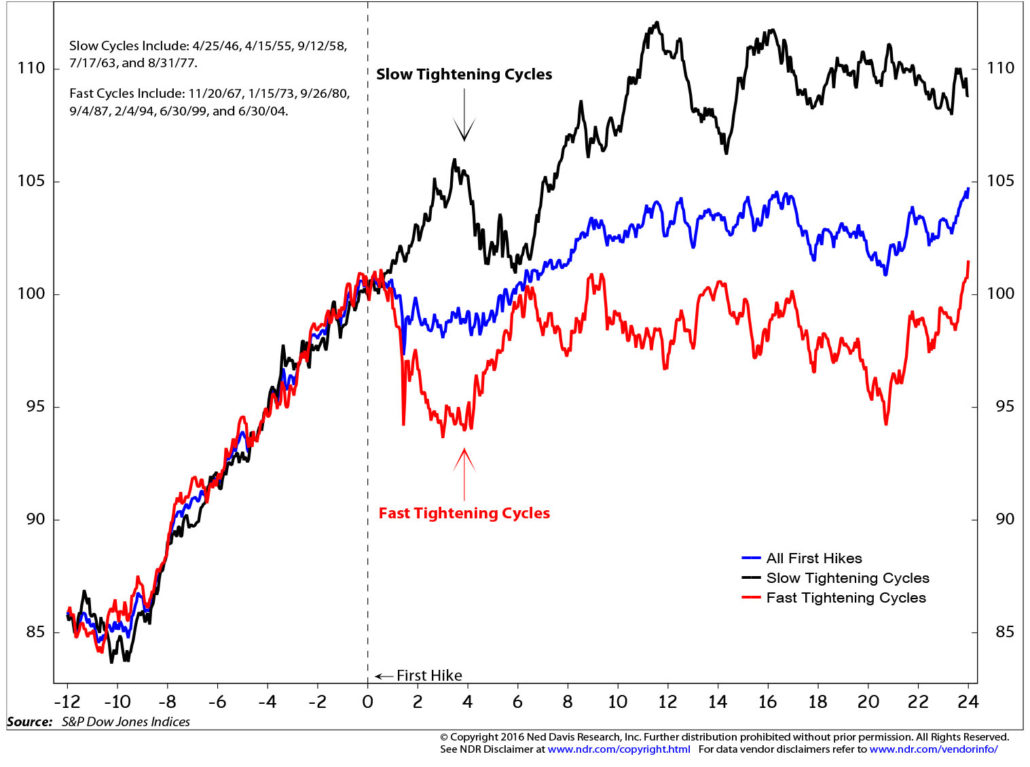

As the Fed starts to raise rates, many investors are assessing how this will impact stocks. It’s important to realize that the Fed’s projected path is considered to be a slow tightening cycle given the fact they have only raised rates twice in the last year. As can be seen on the chart (below), the market performs better when the Fed increases rates slowly rather than quickly. Historically, during a “slow tightening cycle,” the market is up 11% one year after the first rate hike, while the market is down 3% during a “fast tightening cycle”.

S&P 500 Around First Fed Rate Hikes vs. Speed of Hikes

A fast tightening policy is usually the result of genuine inflation fears, which are not present today.

For bond investors, higher interest rates are a double-edged sword. Higher rates mean that you will be able to buy bonds earning higher yields, but the value of bonds already in your portfolio will drop in value. Overall, we see this as a net benefit. The short-term paper losses are temporary. Higher yields in the long term make bonds much more attractive.

When we experience short-term losses in an asset class such as bonds, it’s important to remember why we own these investments. Bonds are intended to preserve principal and to generate a steady stream of income while lowering the overall risk of your portfolio. Bond investments protected portfolios when stocks were tumbling during the 2008 financial crisis. The idea of diversification is based on owning securities that don’t move up and down at the same time.

It’s important to remember that stocks are not substitutes for bonds. Stocks have approximately three times more volatility than bonds. It’s a dangerous trend when investors start to believe that high-dividend stocks serve as a proxy or substitute for bonds. We have seen some investors exhibit this behavior in recent years as they aggressively shifted money from bonds to stocks. Hopefully this is a short-term trend that will stabilize as interest rates continue to increase.

Looking Forward

As we turn our attention to our outlook for 2017, it’s clear that we’ve seen some trends in certain stock market sectors since the election. Financials have been helped by higher interest rates and a belief that regulation will decrease (including possibly lower capital requirements for banks). The energy sector has been helped by higher growth estimates, expected reduced regulation, possible approval of the Keystone pipeline, and promises of reduced supply from OPEC. Industrials have rallied based on promised infrastructure spending. Defense companies have also done well. This isn’t surprising, given Republicans have historically been supportive of our military and now control the White House and both houses of Congress.

As we look ahead, higher interest rates will be a headwind to bond returns over the short-term. But again, we see this as a net positive for our clients since these higher rates will provide more reasonable returns for bond investors in the future.

With respect to stocks, we believe there is still room for stocks to increase in value. There’s no question that stocks have had a great run since bottoming out in March 2009 – they are up more than 250%. We recognize that valuation of the overall market (as represented by the price to earnings ratio) is above average. However, given our belief that interest rates and inflation will remain low over the near-term, we believe that market multiples can stay elevated. In addition, increased government spending, lower personal and corporate tax rates and increased consumer confidence should help stocks going forward. We are hopeful that the market can continue its bull run over the next few years with positive (but below average) annualized returns of 6 to 8%.

Before closing, let me voice one long-term concern. Throughout this article, I’ve mentioned increased infrastructure spending, lower regulation, and lower taxes. While I am certainly supportive of increased infrastructure spending (if focused on the right projects), lower taxes and fewer regulations, our track record has not been very good when it comes to increasing spending while lowering taxes at the same time. Historically, our elected officials have promised us that increased spending will result in increased economic growth and thus lower deficit spending and debt over time. That has not been the case.

As we all know, our debt levels have increased substantially over the last 20 years. My hope is that if Republicans are successful in cutting taxes and/or increasing infrastructure spending, there will be sufficient cuts in spending in order to balance our budget. While I’m skeptical this will occur, I will be encouraged if there are serious discussions on reducing spending going forward, specifically reforming Social Security and Medicare since these programs are expected to be the biggest drivers of our deficit spending going forward.

So, there you have it. It was a year full of surprises. We’re anxious to see how 2017 evolves. We will continue to monitor the markets on your behalf and adjust portfolios as future surprises unfold. Thank you for your business. We wish you a happy and healthy New Year.

James F. Arens II

Executive Vice President & Chief Investment Officer

(918) 744-0553

jarens@trustok.com