A Welcome Return to Normalcy

Navigating the Economic Landscape: A Recap of 2023 and a Glimpse into 2024

BY NICK GALLUS, CFA

Senior Vice President & Director of Investment Research

In the past few years in America, the investing landscape has been anything but normal, kicking off with pandemic stimulus policies in 2020 and 2021, supply chain troubles, drastic swings in supply and demand between goods and services, and a booming housing market. Meme stocks proliferated, and valuations in many parts of the market became overheated, especially technology and venture capital. This excess peaked in late 2021 and brought unwelcome inflation and higher interest rates in 2022 and through much of 2023. Ask the average person on the street, and they would likely agree that they have experienced an increase in hardship and living costs over the past few years, and a return to normalcy would be very much appreciated.

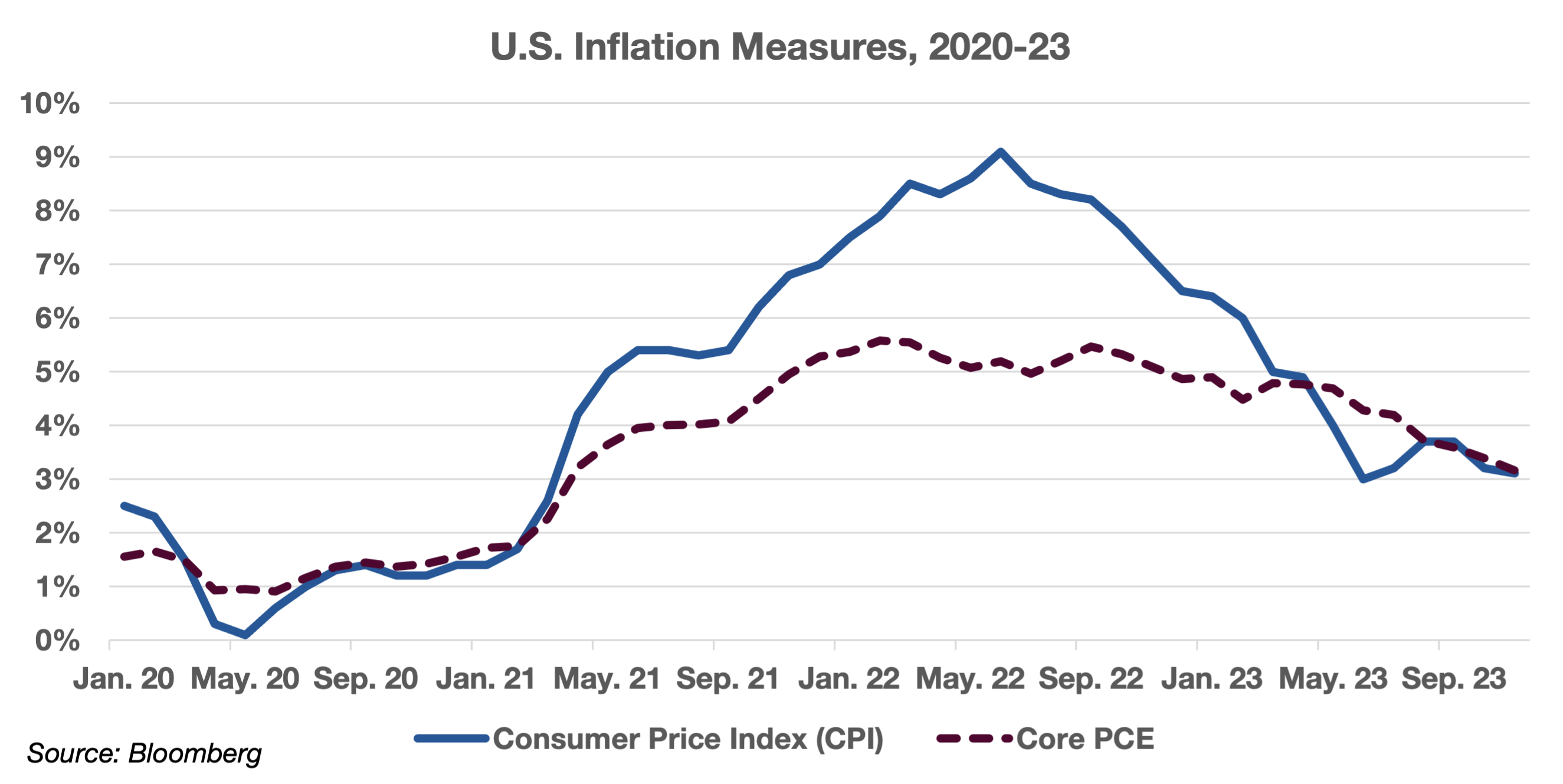

The good news is that after more than two years of rampant inflation, many parts of the economy and market are, in fact, returning to normal. While two-plus years was a very long time, a look back at similar historical periods of inflation spikes shows that the most recent episode was, in fact, fairly average. A dozen historical examples from 1940 to the present show the average length of time from a period of below 2% inflation to peak inflation is approximately 21 months, then an additional 24 months to return to 2% inflation.

This time, official CPI inflation rose from a low of just 1.2% in 2020 to a peak of 9.1% in June 2022. (See the chart “U.S. Inflation Measures, 2020-23” below.) While official CPI continues to trend downward because of lagged effects in the calculation, inflation has been near 3% year over year since May 2023, according to the website Truflation.com, a service that aims to track inflation in real time. After three years of pain during which consumers saw inflation rise a cumulative 17.7% from the end of 2020 through 2023, this is a welcome reprieve.

Most importantly, the inflation outlook is much improved, with the average economist expecting CPI to rise 2.6% this year, followed by a 2.3% rise in 2025. If inflation continues on the path of deceleration, the Federal Reserve will be able to ease the brakes of high interest rates, which were raised to a range of 5.25% to 5.5% at the end of July 2023. Along with higher Federal Reserve rates, the 10-year U.S. treasury yield also increased from 3.9% at the beginning of last year to a peak of 5.0% in October 2023.

However, history shows that after the last Federal Reserve rate increase, intermediate-term interest rates typically decline modestly over the next one to two years by 0.5% to 1.0%.

With inflation stabilizing, this normalization of interest rates would also be welcome news to investors. More likely than not, the Fed is done raising interest rates this cycle – the bond market currently implies that the first Federal Reserve rate cut will take place in March of this year.

Stock Market

Meanwhile, compared to the slower-moving bond market, the outlook for the stock market is far less certain after a Fed rate pause. Over the past 90 years, stock market performance after a pause has ranged from -40% (during the Great Depression) to +30% 1 ½ years after the rate pause. The performance of stocks this year will depend on the shape or severity of the economic recovery or slowdown, change in interest rates, and any wild card factors, such as unforeseen geopolitical events. If the ideal economic “soft landing” comes to fruition, a strong market rally similar in magnitude to 1984 or 1995 is possible, with continued strong market gains. It’s worth noting that beginning in 1994 and 1995, the internet and associated technology boom took off in earnest, leading to five years of strong U.S. stock market gains.

Conversely, if the U.S. slips into recession and corporate earnings decline, the market could experience a -20% correction. While we don’t have the magic crystal ball to predict the future with certainty, history tells us the outlook for the market is relatively normal again, in that it will most likely be determined by economic growth and corporate earnings, rather than abrupt and substantial changes in the inflation outlook or interest rate environment. As one former colleague used to say, “Earnings are the mother’s milk of stock performance.”

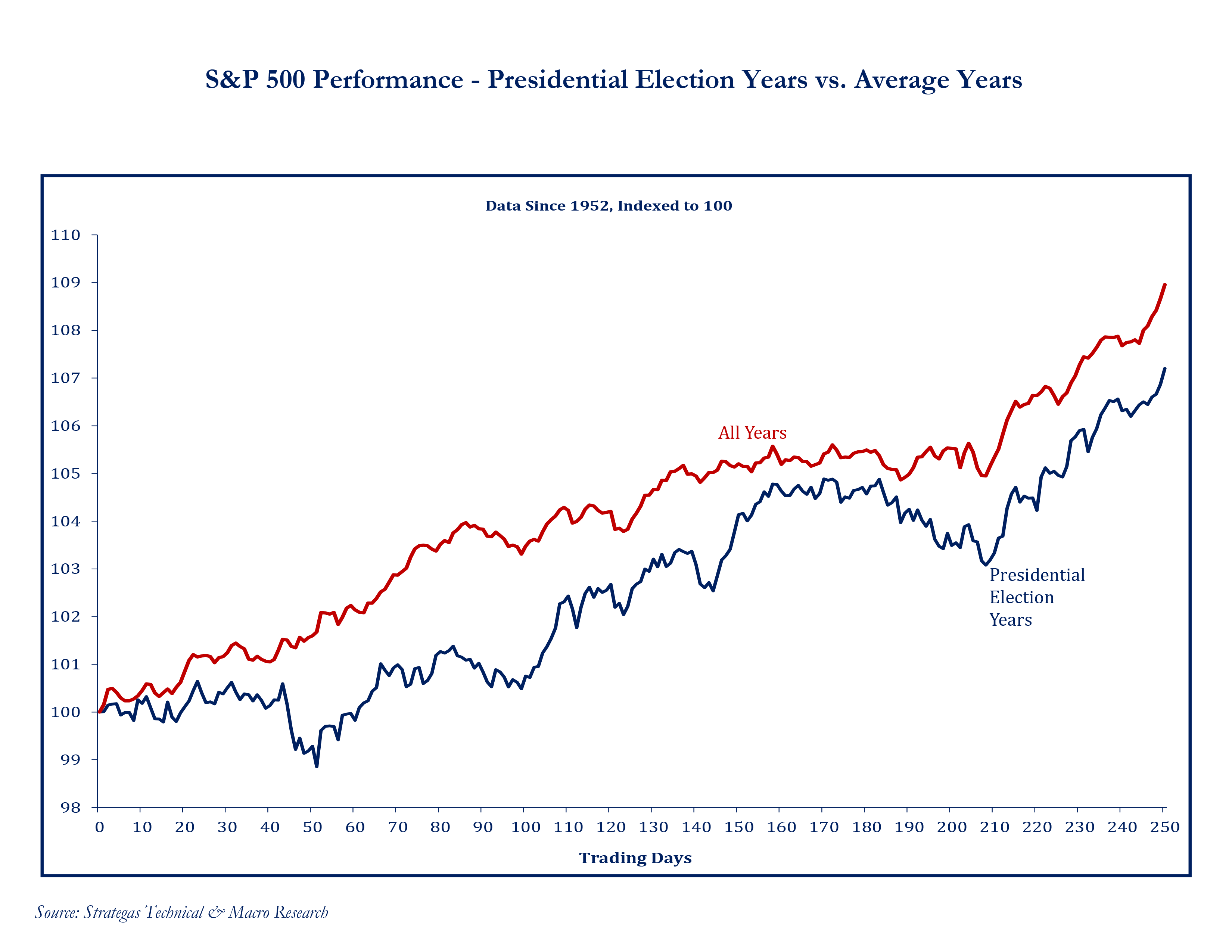

Turning the page to 2024, American politics may not yet be returned to normal, but the possibility exists that this year’s may be less dramatic. Stock market performance is typically different in presidential election years than in other years. (See the chart “S&P 500 Performance – Presidential Election Years vs. Average Years” below.) The market usually experiences more than average volatility, particularly in the early months of late winter and early spring, when uncertainty is high regarding the challenging party’s nominee for the election. A bumpy spring is often followed by better market performance over the summer, with additional market weakness in the fall right before the November election.

The last two months of presidential election years often end on a strong note once uncertainty is clarified with a winner.

Adding this all up, 2024 is shaping up to be perhaps the first relatively normal year for the markets in quite a while: moderate inflation, normalized interest rates, stock valuations close to long-term averages, and performance driven by earnings growth. With a little luck, maybe politics will return to a sense of normalcy after the excessive division of the past few years. We can all hope for the best.

What could surprise in 2024?

While it’s nice to think that market conditions will be normal again this year, what could surprise markets in the year ahead? There will undoubtedly be some surprises in 2024, as always, but hopefully those surprises will be much more manageable than in recent years.

Resurgent Inflation / The Fed Pivot

In mid-December, the Federal Reserve held their final meeting of 2023, surprising markets by indicating they expect to cut interest rates three times in 2024 after raising rates to over 5.25% in July 2023. As of this writing, markets expect interest rates to end the year at 3.75%. While we commend the Fed for looking forward and anticipating the impact of recent interest rate increases on bringing down inflation, this raises concerns that the Fed may be letting off the brakes too soon. Real-time measures of inflation have hovered around 3% since mid-May 2023, while core PCE (the Fed’s preferred measure of inflation) was up 3.2% year over year in November. Although the pace of deceleration is encouraging, one would expect a period of below 2% inflation following a two-plus yearslong spike before settling near the Fed’s stated 2% long-term target. Easing too quickly raises the risk that an unwelcome rebound of higher inflation returns later in 2024 if the economy remains strong and the labor market stays tight.

Continued Technology Gains

While a rebound of inflation appears to be the biggest risk in 2024, the biggest potential positive surprise for markets could be a continuation of the artificial intelligence spending boom that began in 2023. The magnitude of stock returns (Magnificent 7 stocks up over 100% in 2023) has been surprising, but one cannot help but compare the current AI trend to the internet boom of the late 1990s or the golden era of mobile growth in the 2010s. In both cases, the trends in shifting consumer preferences lasted a decade or more. At the same time, the dominant technology companies leading the charge outperformed broader market indices for several years as earnings surprised investors to the upside.

While the AI trend has been stealthily building steam for several years via tools such as recommendation engines on Amazon and Netflix, this next round of software built with large language models could be game-changing regarding worker productivity. For example, the initial adoption of ChatGPT, and associated capital expenditures of the technology industry on semiconductors, data centers, and software tools has been staggering. Microsoft, Amazon, and Alphabet, all of which have large and growing cloud/AI businesses, are collectively expected to spend $137 billion on long-term capital expenditures in 2024. This is an incredible number, and it only accounts for three of the largest companies in the technology industry. Furthermore, this figure also does not include ongoing research and development expenses. Surprisingly, large companies’ AI spending is in a lull while many companies organize and prepare internal data for future use in tools/models. The larger ramp in AI spending may be yet to come as 2024 progresses and we move into 2025. Stay tuned for further development in this area.

There is a risk in investing in technology: What is hot at one point in time can turn out to be a fad and peter over the next few years. Examples of such fads include 3D printers and virtual reality sets, such as Oculus. However, we don’t think this is the case with AI tools. In a recent study performed by the Boston Consulting Group, younger career consultants experienced a 25% improvement in their productivity and a 40% improvement in work quality when trained using ChatGPT-4, compared to a control group not using the AI tool. If tools such as ChatGPT can make highly paid white-collar workers significantly more productive, enormous sums of corporate dollars will surely follow in the years ahead, boosting worker productivity and corporate profits.

Longer-Term Implications

Lastly, while inflation and AI may seem unrelated, the potential for meaningful long-term positive impact from AI on worker productivity could spill across much of the economy and markets. Thinking through potential long-term implications:

- AI tools could increase worker productivity, easing wage-related inflation pressures

as companies capture the benefit of AI while also being able to pay workers more. - GDP growth could accelerate, growing the economic pie for all Americans.

- Increased worker productivity could reduce the need for higher interest rates in the face of a tight labor market and persistent government deficit spending.

- Many of the early winners from AI spending are U.S.-based technology companies, which could drive continued strong stock performance and a positive feedback loop for workers, companies, the market, and the economy in aggregate.

Whatever happens this year, investing is always an intriguing endeavor with surprises. Hopefully, 2024 will be more “normal” than in recent years. We hope you had a wonderful holiday season, and we are looking forward to what the future brings.

NICK GALLUS, CFA

Senior Vice President & Director of Investment Research

(918) 744-0553

NGallus@TrustOk.com