Making the Right Choice for What You Can’t Take With You

By M. Shawn Crisp

The American Taxpayer Relief Act of 2012 (ATRA), made the relatively recent estate planning option of portability permanent.

What is portability? Simply put, portability allows the surviving spouse to use any remaining gift/estate tax exemption of his or her deceased spouse. The lifetime gift/estate tax exemption for 2014 is $5.34M per person. Portability allows the surviving spouse to use whatever portion of the exemption their deceased spouse didn’t use, as well as their own exemption amount.

More specifically, if the first spouse to die does not use all of his or her gift/estate tax exemption, the executor of the first spouse’s estate may elect to give the use of the remaining exemption to the surviving spouse. The surviving spouse can then use that exemption amount to make lifetime gifts or to shelter bequests at death. Thus portability provides an alternative to the traditional estate planning technique of using a bypass or credit shelter trust (CST). As a quick refresher, prior to the days of portability, in order to not waste or lose the deceased spouse’s unused exemption amount, a CST was funded with all of the decedent’s remaining estate tax and generation skipping transfer (GST) tax exemption as of his or her death.

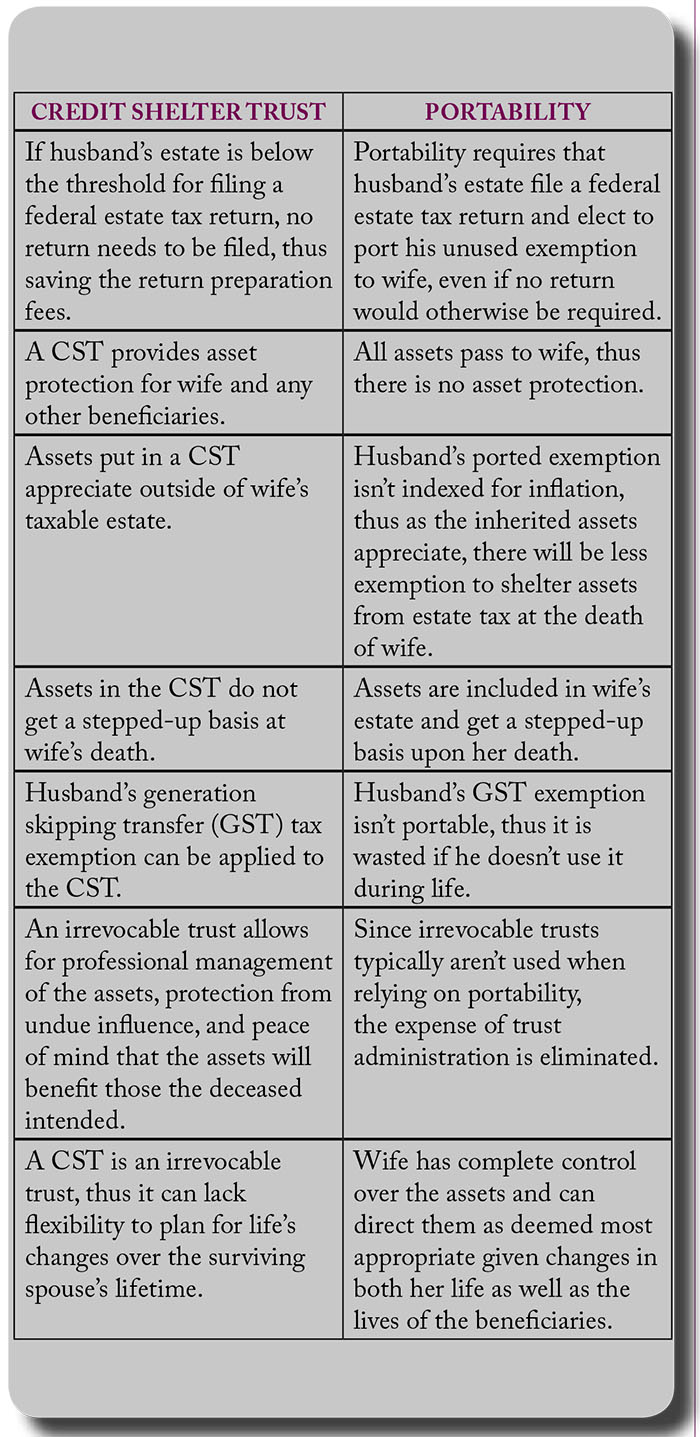

A good way to see the pros and cons of whether to go the CST route or rely on portability is to walk through an example. For the purposes of this example, we will assume that the husband dies first as shown in the chart below.

Several factors may impact whether utilizing a CST or simply relying on portability is appropriate. Some of the key factors to consider when discussing your estate plan with your advisor include:

• Overall value of the estate, asset composition and anticipated growth

• Health and/or age differences between the spouses – likely period of time between the two deaths

• Likelihood of the surviving spouse remarrying and/or children from prior marriages

• Need for GST tax exemption, changes in the various tax rates, namely estate, capital gain, and income taxes

Should you have any questions regarding whether relying on portability or utilizing a CST is right for your estate plan, please contact us. We will be happy to discuss the pros and cons of each approach with you and your attorney to help determine which option is the best fit for your situation.