AI: The Next Revolution?

Examining the Impact and Implications of Artificial Intelligence on Markets and Beyond

BY GARRETT GUINN, CFA

Assistant Vice President

While rising inflation monopolized headlines in 2022, artificial intelligence (AI) has captured the imagination of investors in 2023, and has steered both the S&P 500 and Nasdaq 100 to fresh year-to-date highs. The embrace of AI by the world’s largest companies is a welcome relief to the recent bear market, but it’s critical to understand its far-reaching implications and how it will affect us moving forward.

AI’s History

Let’s take a step back to understand how we got here. Before AI became the latest buzzword in corporate earnings calls, scientists, mathematicians, and philosophers pioneered it as far back as the 1950s. The technology made slow and steady progress over the decades, limited primarily by costly computing power. Still, it achieved a landmark goal in 1997 when IBM’s Deep Blue, a chess-playing computer program, defeated reigning world chess champion and grandmaster Garry Kasparov.

Fast forward 20 years, and in 2017 Google’s AlphaZero program defeated Stockfish 8, the world’s 2016 computer chess champion. Stockfish 8 had centuries of accumulated human experience, decades of computer experience, and could calculate 70 million chess positions per second. AlphaZero, on the other hand, could calculate merely 80,000 chess positions per second, and its developers did not teach it any chess strategies. Instead, the creators of Google’s AlphaZero chess program implemented the latest machine-learning principles to let the program self-learn chess — in only four hours — by playing against itself. Out of 100 matches between AlphaZero and Stockfish 8, Google’s AlphaZero won 28 and tied 72. It didn’t lose a single game.

The recent AI craze among the general public began late last year with the release of ChatGPT by OpenAI, a research-oriented company founded in 2015 by Elon Musk, Sam Altman, Ilya Sutskever, and others. OpenAI was initially formed as a nonprofit tasked with building safe AI technology for the benefit of humanity. However, in 2019 the company created a for-profit arm, allowing it to raise billions of dollars from Microsoft and develop increasingly expensive models such as ChatGPT.

What makes ChatGPT and similar chat tools so unique is that they’re not simply AI, which essentially consists of algorithms used to classify and predict something, but they’re considered generative AI. Generative AI can generate text (e.g., ChatGPT responding to your queries), art (e.g., DALL-E generating an image based on a prompt such as “an astronaut playing basketball with dogs in space”), computer code, etc., and it’s currently driving the next wave of innovation.

For consumers, ChatGPT has attracted users to its platform so people can quickly get suggestions for an affordable family vacation, write a homework report on the U.S. Revolution, or make a reservation for dinner at their favorite Thai restaurant. Rather than search, evaluate, and click multiple links in a simple query, people can ask questions and receive detailed human-like responses in seconds. Users can also review and access the links in ChatGPT’s response if they want additional information.

In response to ChatGPT, companies like Google, Microsoft, and Salesforce have released their own competing AI-driven products: Bard, Bing Chat, and Einstein GPT, respectively.

It’s highly likely the spotlight will be fixed on AI going forward as companies leverage this technology to drive efficiencies within existing products and services, and spur the next evolution of innovation.

AI and Markets

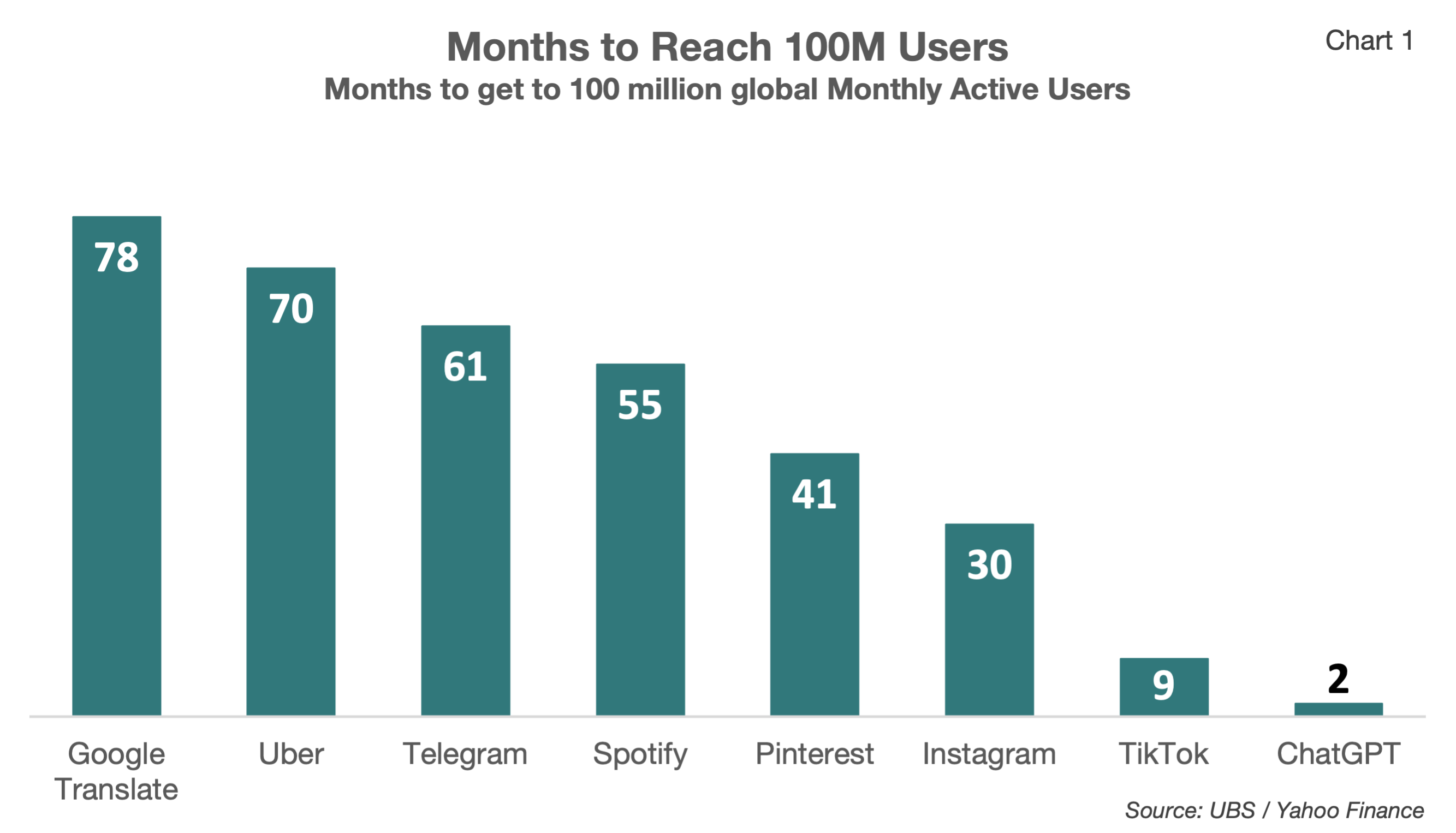

One of the key questions here is whether the recent hype in AI is warranted and, if so, to what degree will it resemble previous technological advancements like the printing press or the internet? After its release to the public in November 2022, ChatGPT reached 100 million users after two months, making it the fastest-growing app of all time (see Chart 1 below) and far outpacing the likes of runners-up TikTok and Instagram.

AI benefits from user engagement, improving its performance by learning from users, and progressively generating higher-quality content. Thus, large tech companies will further benefit in this next technological leap forward by having access to immense, high-quality, and proprietary data (possessed by the likes of Google).

Moreover, to play in this game there’s a prerequisite: You need to have deep pockets. It was reported that OpenAI spent approximately $545 million last year alone developing its AI models and that Microsoft would invest an additional $10 billion in OpenAI.

The interest in adopting AI is not limited to tech giants; even established consulting firms such as PwC and Accenture have recognized its usefulness and have committed billions of dollars toward expanding and scaling their AI offerings.

While the cost per computing unit has declined over the past few decades, the price to effectively scale AI models has risen rapidly, significantly raising the barrier to entry for startups and companies with comparatively fewer resources. This sentiment is shown in the year-to-date performance among the “AI stocks” — essentially Facebook, Apple, Tesla, Google, Amazon, Microsoft, and the S&P 500 Semiconductors & Semiconductor Equipment Index — and the remainder of the S&P 500.

The immediate impact of AI on stock returns this year has led to greater concentration within the S&P 500, where more than 100% of the year-to-date gains (through May 31) came from the top 10 weighted stocks, an unprecedented level of outperformance; the bottom 490 stocks in the index surprisingly fell 4.3%.

The year-to-date outperformers benefitting from AI have robust business models that complement this new technology and immense amounts of proprietary data. For example, Nvidia, the premier GPU (graphics processing unit) chip designer for AI platforms, recently approached the $1 trillion market capitalization threshold after forecasting current-quarter sales of nearly $11 billion, up 64% from a year earlier and significantly higher than the $7.2 billion expectation on Wall Street. In a single day, Nvidia’s market capitalization increased by nearly $184 billion, making it one of the most significant one-day market capitalization gains in American corporate history. For perspective, the one-day gain in market capitalization for Nvidia on May 25 was greater than the entire market capitalization of Disney and about equal to that of Netflix.

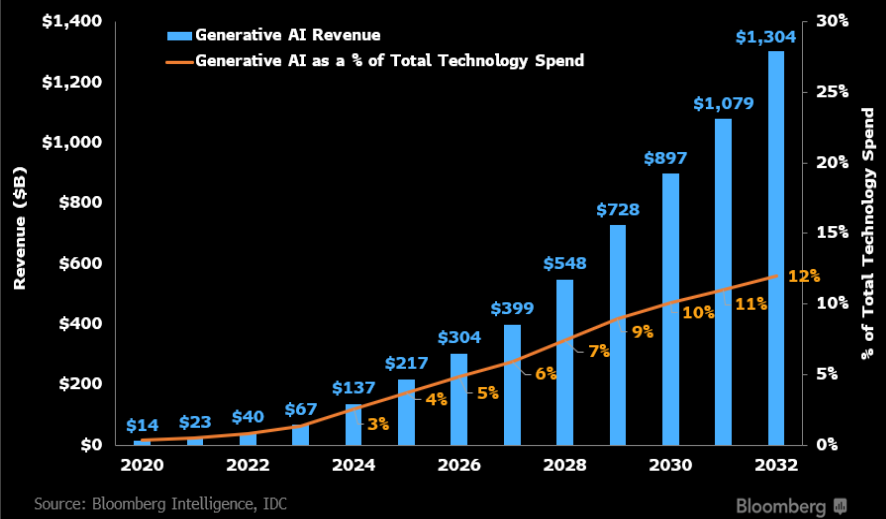

Bloomberg Intelligence projects the total market for generative AI will increase from $67 billion in 2023 to $1.3 trillion by 2032 and capture about 10% to 12% of total technology spend (see Chart 2 below). The primary drivers for generative AI growth include infrastructure-as-a-service used to train large language models ($247 billion), digital advertisements ($192 billion), servers ($134 billion), and conversational devices ($108 billion).

Chart 2

The enthusiasm for generative AI seems well-founded due to evidence that companies across all industries can adopt it and the technology may drive significant efficiencies. Furthermore, generative AI is still a nascent technology with plenty of room for growth, as described above, with 70% of organizations polled in a Gartner survey claiming to be in the exploration stage. The survey data also indicate that most executives believe investment in enterprise-grade generative AI outweighs the risk, suggesting a meaningful generative AI adoption cycle is on the horizon.

Although the accuracy of any long-term forecast is always subject to scrutiny — be it this weekend’s weather or next year’s Super Bowl champion — there is little doubt that generative AI will develop into a substantial market, spanning from hardware and software to gaming, advertising, and business services.

Overall, this year’s investing landscape has turned surprisingly positive — developing into a technical bull market — as job growth remains supportive, inflation concerns wane, and banking headwinds remain contained. Moreover, when reviewing data from Bloomberg Intelligence, we can see positive 12-month forward returns in times, similar to today, when there is narrow market outperformance (i.e., Apple, Microsoft, Google) compared to overall stock market returns. Looking forward, we will continue actively monitoring developments in this technological revolution to identify attractive opportunities.

GARRETT GUINN, CFA

Assistant Vice President

(918) 744-0553

GGuinn@TrustOk.com