Cracking the Medicare Code

What You Need to Know Before Signing Up for Medical Coverage

MEDICARE ENROLLMENT

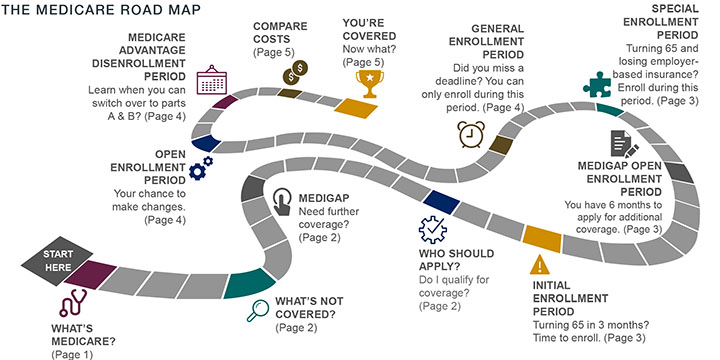

Buckle up! Turning 65 means signing up for Medicare. You are not alone: over 10 thousand Baby Boomers turn 65 each day for the next 20 years, with almost 50 million Americans currently covered by Medicare, according to the Social Security Administration. Even though Medicare touches so many citizens, most are confused about the enrollment process due to a shortage of clear information about this program. As a result, many don’t have the knowledge they need to enroll without incurring penalties or to prepare for the costs Medicare does not cover. To learn more about the ins and outs of Medicare, begin with the road map below.

WHAT’S MEDICARE?

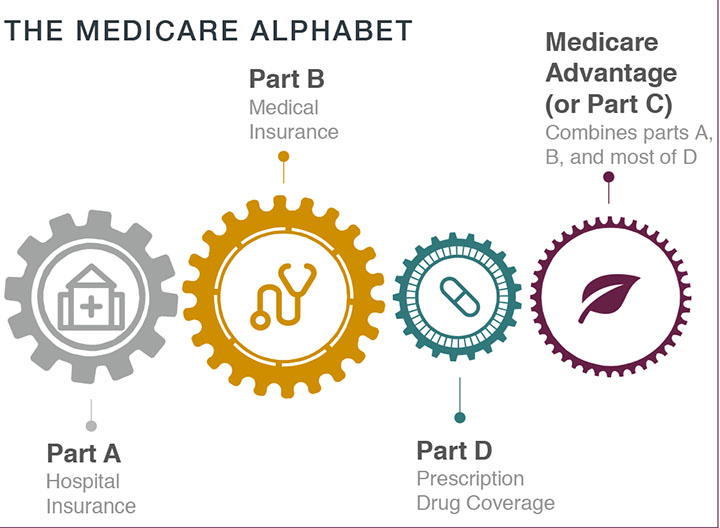

Medicare is a federal insurance program funded with payroll taxes. It is divided into four parts:

PART A – HOSPITAL INSURANCE

Helps cover inpatient hospital care, skilled nursing facility care, nursing home care, hospice, and home health services. Most people don’t pay premiums because they paid Medicare taxes while working.

PART B – MEDICAL INSURANCE

Covers medically necessary services (services and supplies needed to diagnose or treat medical conditions) and preventive services (health care to prevent or detect illnesses at an early stage). This helps cover outpatient healthcare including doctor visits, vital services and mental health care. Monthly premium required.

PART D – PRESCRIPTION DRUG (OPTIONAL)

In order to get Medicare prescription drug coverage, you enroll in a plan run by a private insurance company. Each plan will vary in cost and what drugs are covered.

PART C – ALSO KNOWN AS MEDICARE ADVANTAGE Combines parts A, B, and D. It is not supplemental, but offered by private companies approved by Medicare. Each Medicare Advantage plan can have different out-of-pocket costs and rules for how to get services, and these rules can change each year.

WHAT’S NOT COVERED BY PART A & PART B

Unfortunately, Medicare parts A and B do not cover everything. If you need services not covered by Medicare, you’ll have to pay for them yourself (unless you have other insurance or a Medicare health plan that covers them). Even if Medicare does provide coverage, you will have to pay your deductible, coinsurance, and copayment. Items and services Medicare doesn’t cover include long-term care, most dental care, accupuncture, and hearing aids.

MEDIGAP (AKA MEDICARE SUPPLEMENTAL PLAN)

Medigap is a solution for those who are using parts A and B but want further coverage in case of unexpected bills. Medigap is a private optional health insurance designed to help pay some of the costs (“gaps”) that parts A and B don’t cover, such as co-payments, co-insurance, and deductibles.

HOW TO APPLY?

Before your 65th birthday, visit your local Social Security office, check Medicare.gov, and discuss with your financial advisors to ensure the coverage you choose is the right financial and health care decision for you.

WHO SHOULD APPLY?

You qualify for part or all of Medicare coverage if you:

1. Are turning 65 or older; or

2. Have been receiving Social Security disability benefits for at least 24 months; or

3. Have a severe disability; or

4. Have end stage renal disease.

MOST RETIREES FALL INTO ONE OF THE FOLLOWING CATEGORIES

1. TURNING 65, NOT RECEIVING SOCIAL SECURITY BENEFITS, WITH NO QUALIFIED EMPLOYER-BASED HEALTHCARE COVERAGE

You can enroll in Medicare parts A, B, D, and Medicare Advantage. You must enroll during your Initial Enrollment Period (IEP) unless you are eligible for a Special Enrollment Period (SEP).

If you do not enroll in Medicare on time and are not eligible for an SEP, you will pay lifelong penalties and delay your access to Medicare coverage.

2. TURNING 65 AND ALREADY RECEIVING SOCIAL SECURITY BENEFITS

You will be automatically enrolled in Medicare parts A and B because you are already receiving Social Security benefits. However, you need to apply for Part D during your IEP or you will face penalties. Likewise, if you want a Medicare Advantage plan instead of original Medicare, you must apply during your IEP.

If you are covered by a qualified employer health plan, you might want to refuse Part B by contacting Social Security before your 65th birthday month.

3. OVER 65 AND LOSING QUALIFIED EMPLOYER-BASED COVERAGE

You can sign up for parts B and D or a Medicare Advantage plan without penalty during your special enrollment period (SEP). This period usually lasts for eight months after employer-based coverage ends. You have only two months after losing drug coverage in order to sign up for a Part D plan without incurring a late penalty.

WHEN TO APPLY? DEADLINES AND PENALTIES

There are different time periods when you can sign up, make changes or disenroll. If you miss a date, you will face penalties or higher premiums for as long as you are covered by Medicare. Watch for those key deadlines.

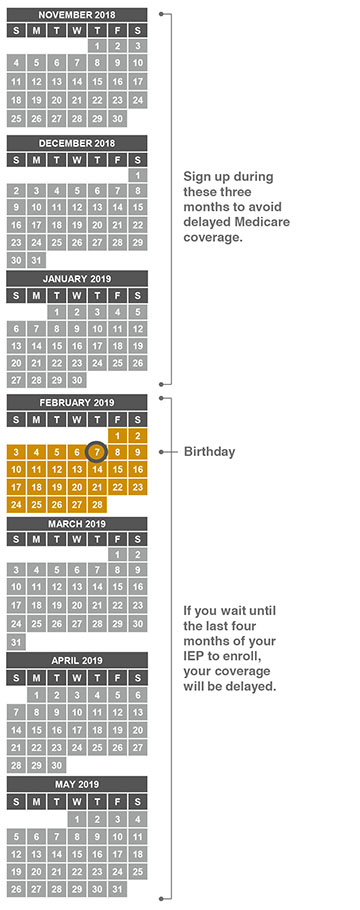

INITIAL ENROLLMENT PERIOD (IEP)

This is your most important window for enrollment. It begins three months before your 65th birthday month, and it ends three months after your birthday month. Let’s say your birthday is February 7. As you can see below, your IEP window is 11/1/18 through 5/1/19.

MEDIGAP OPEN ENROLLMENT PERIOD

During this period, you can buy any Medigap policy sold in your state, even if you have health problems, without being subject to medical underwriting or health-adjusted premiums.

This six-month period begins on the first day of the month in which you are 65 or older as long as you are enrolled in Medicare Part B (medical insurance).

After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more and you may be denied Medigap coverage completely.

If you delayed Part B enrollment, your Medigap Open Enrollment Period begins the month that you first enroll in Medicare Part B and lasts for 5 months.

SPECIAL ENROLLMENT PERIOD (SEP)

These are windows of opportunity to enroll in certain parts of Medicare outside of your IEP.

If you have been covered under a qualified employer group health plan, you are granted an SEP to sign up for Medicare parts A, B, D, and Medicare Advantage when your employer coverage ends.

Parts A & B: Your SEP lasts eight months after employer coverage ends.

Parts D & C: You will need to enroll within two months after employer coverage ends.

If you miss your SEP, you will have to wait for the next General Enrollment Period and may pay lifelong penalties.

GENERAL ENROLLMENT PERIOD (GEP)

If you did not enroll when you first became eligible under your IEP or SEP, you may enroll in Medicare parts A, B, D, and Medicare Advantage coverage during the General Enrollment Period. Coverage becomes effective July 1.

OPEN ENROLLMENT PERIOD (OEP)

The OEP is also known as Annual Election Period. This is your annual opportunity to change Medicare Part D prescription plans, and to enroll in or make changes to Medicare Advantage. Changes take effect January 1 of the following year.

MEDICARE ADVANTAGE DISENROLLMENT PERIOD

During this period, you can disenroll from a Medicare Advantage plan and switch to Medicare parts A, B, and D. Changes take effect the first day of the following month. See the 2019 disenrollment period below.

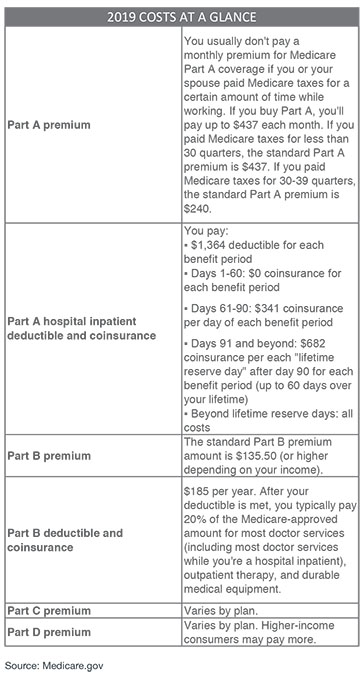

COMPARE COSTS

Before the time comes to choose between Original Medicare or a Medicare Advantage Plan; whether or not to get prescription drug coverage; and to decide if you want Medigap, it is important to consider the monthly costs. For 2019 Medicare costs, see left.

If you want to compare costs for health care plans, visit Medicare Plan Finder at Medicare.gov/find-a-plan.

For information about your Medicare coverage (whether you’ve met your deductible, how much you’ll pay for an exam or service, or to check the status of a claim), visit MyMedicare.gov.

YOU’RE COVERED. NOW WHAT?

Once you sign up for coverage you will receive your Medicare card in the mail. If you’re automatically enrolled, you’ll get your Medicare card in the mail three months before your 65th birthday or your 25th month of getting disability benefits – whichever comes first.

The card shows whether you have Part A, Part B, or both, and it indicates the date your coverage starts.

Your card will have a Medicare number that is unique to you. This it to protect your identity.

Be sure to carry your card with you when you’re away from home. Let your doctor, hospital, or other health care provider see your card when you need health services.

REPLACING YOUR MEDICARE CARD

If you need to replace your card because it’s damaged or lost, sign in to your MyMedicare.gov account to print an official copy of your Medicare card.

WATCH OUT FOR SCAMS

Only give your Medicare number to doctors, pharmacists, health care providers, your insurers, or people you trust to work with Medicare on your behalf. Medicare will not call you uninvited and ask you to provide personal information. Criminals may try to get your Medicare number. If someone asks you for personal information, for money, or threatens to cancel your health benefits if you don’t share your personal information, hang up and call 1-800-MEDICARE (1-800-633-4227).