Disconnected and Detached

Stock Market v. Economic Reality

This year has been a very volatile one for the stock market. After reaching an all-time high on February 19, the S&P 500 declined 34% in just 33 days as the coronavirus pandemic caused a severe and rapid sell-off. After bottoming on March 23, the market quickly turned around with the S&P 500 rising 18% in the next three days. The market then went on to set a new all-time high on August 18, closing at 3,390, surpassing its prior record of 3,386 on February 19.

The whole chapter, from peak to peak, spanned 126 trading days and marked the index’s fastest-ever recovery from a bear market. Typically, bear markets take several years to recover previous highs, as the economy heals and businesses start thriving again. At approximately six months, this bear market recovery was about 17 months faster than the previous record after the 1987 crash, and almost five years faster than the median recovery.

100 DAYS

When the market set its new high on August 18, it was just a few days past the 100 trading day mark since the March 23 low on August 13. During that period, the S&P 500 gained 53%, the strongest 100-day gain since the 1933 recovery from the depths of the Great Depression.

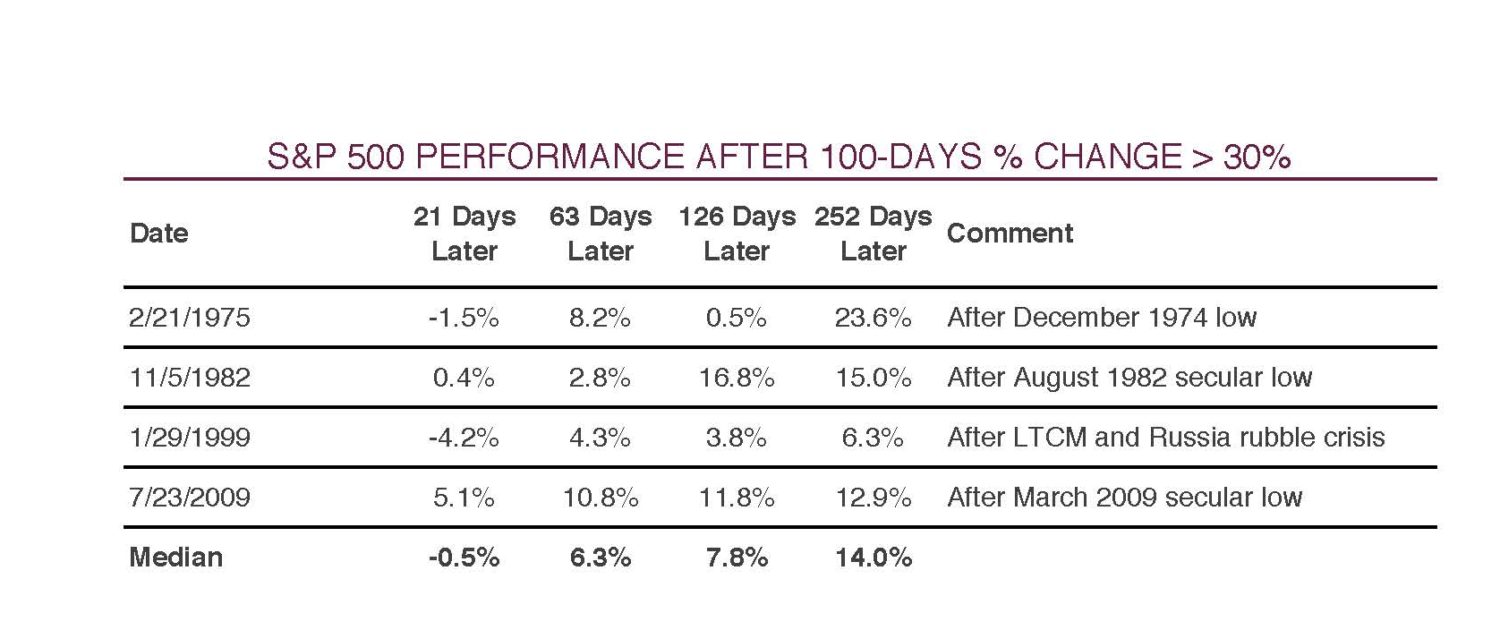

Since WWII, the S&P 500 has gained more than 30% over a 100-day period only four times (see table below).

SOURCE: STRATEGAS

Three of those four times came after some of the most significant post-war lows for the U.S. stock market.

The fourth instance, January 1999, occurred during what proved to be the final stage of the Dotcom Bubble. Though short-term results have varied, one year later the S&P 500 achieved a median-gain of 14%. At least in the past, following strong 100-day gains, the positive momentum in the market has tended to continue.

THE 2020 BULL MARKET

Many economic observers and investors can’t understand or rationalize the strong stock market gains achieved since the bear market low of March 23 with the current national and global economic environment. Indeed, the U.S. unemployment rate jumped to 14.7% in April, the highest level since the Great Depression, as many businesses shut down or severely curtailed operations to try to limit the spread of COVID-19.

The Labor Department reported that 20.5 million people abruptly lost their jobs in April, wiping out a decade of employment gains in a single month. The speed and severity of job loss is unprecedented. It is approximately double the number of jobs lost in the U.S. during the entire financial crisis from 2007 to 2009.

However, since April, the rate of unemployment has declined rapidly to 8.4% in August. Analysts think that it could take years to return to the 3.5% unemployment rate the nation recorded in February, in part because it is unclear what the post-pandemic economy will look like, even if scientists continue to make progress on a vaccine. In addition, second quarter gross domestic product (GDP) year over year growth, announced in late July, was -9.0%, the biggest single-quarter decline in GDP since 1947, when the government began tracking the figure using modern methods.

Despite the current economic recession, it is important to note that the previous economic expansion, from July 2009 to February 2020, was the longest economic expansion on record.

WHY IS THE STOCK MARKET STRONG WHILE THE ECONOMY IS SHOWING SIGNS OF SLOWDOWN?

Many believe that the stock market could not be more divorced from the country’s broader economic situation. However, there are several factors that can at least partially explain this dichotomy:

First, the stock market is forward-looking whereas current economic data is primarily backward looking. Investors are betting on what the world and the economy will look like in 6-12 months, not what they look like today.

Secondly, the stock market’s returns this year have been deeply split between the outperformers and underperformers. Recent market gains have been driven by the outperformance of a handful of big technology and communication services companies which are heavily weighted in the market indexes.

This continues a trend that was prevalent during the 11-year bull market. In fact, at the time the S&P 500 made a new recovery high on August 18, the five most heavily weighted stocks in the Index gained an average of over 65% in the prior 12 months whereas the other 495 stocks in the index gained an average of 1%. Thus, the broad market is not as distanced from the economy as it appears.

Third, effective treatments limiting the severity of COVID-19 have been successful. Almost daily positive headlines regarding a potential vaccine have given investors hope that a safe and effective vaccine will be available in the next 6-9 months. The quick approval and distribution of a vaccine would shore up the remaining weaknesses in the economic recovery, consumer sentiment and unemployment, to further boost equities.

Fourth, probably one of the most significant factors fueling the markets recovery from the lows is explained with the acronym TINA, which stands for “There Is No Alternative.” Given record low interest rates available on competing investments available to investors such as bonds, certificates of deposit, etc., many believe that the stock market is a more attractive place to commit new investment funds.

On August 27, Chairman of the Federal Reserve Jerome Powell announced a major shift in how the Central Bank guides the economy, signaling it will no longer necessarily raise interest rates to keep the unemployment rate from falling too far and that it will aim for long-term average inflation of 2%.

This effectively means the Fed is willing to accept periods of higher inflation following periods of lower inflation and vice-versa. In emphasizing the importance of a strong labor market and aiming for moderately faster price gains, Powell and his colleagues laid the groundwork for years of low interest rates. That could translate into long periods of cheap mortgages and business loans that foster strong demand and solid job markets.

Lastly, both monetary and fiscal stimulus in response to the COVID-19 crisis have been unprecedented, totaling $5-6 trillion in the span of just six months. Federal Reserve purchases of Treasury, mortgage, as well as (for the first time) corporate and municipal bonds, have brought stability to the bond markets, underpinning the stock market recovery.

GOING FORWARD

In what has already been a volatile year for financial markets, they will probably exhibit continued elevated volatility ahead of the November election. However, it is important to not lose sight of the bigger picture and remember that despite 19 pullbacks of greater than 5%, stocks rose more than 500% during the previous bull market.

Declines such as these are, unfortunately, the admission price to participating in the market and experiencing its longer-term appreciation potential.

Nonetheless, given the Federal Reserve’s commitment to keep interest rates low for an extended period of time and expected further economic recovery from the effects of the pandemic, stocks should continue to be one of the best tools to build wealth over time.

Tim Hopkins, CFA

Senior Vice President

(405) 840-8401

THopkins@TrustOk.com