Rethinking Portfolio Diversification

S&P 500 Concentration and Tech Growth Have Changed the Landscape of Investing

BY REBECCA MITCHELL, CFA

Vice President

There is a well-known phrase, used inside and outside of investing: “Don’t put all of your eggs in one basket.” What if you thought you disbursed said eggs quite well, only to find out more of them were in one basket than you thought? In an age of mutual fund and ETF investing, many investors find themselves in that situation. We are in a time when a few stocks take up a more significant portion of the market than many investors realize.

The S&P 500’s Impact on Diversification

One of the primary reasons investors choose investment vehicles like mutual funds and ETFs is the benefit of diversification. You purchase one share of a fund, and your portfolio immediately holds dozens, if not hundreds, of stocks. A market capitalization weighted fund is the most popular, where each stock is given a weight in the fund based on its size. An equal weighted fund is the other option, where each stock is given equal weight.

Arguably, the most popular funds track the S&P 500 in some way, and for good reason. The S&P 500 encompasses about 80% of U.S. market capitalization and about 50% of the global market. This is why the response to “How is the market doing?” is often related to how the S&P 500 is performing.

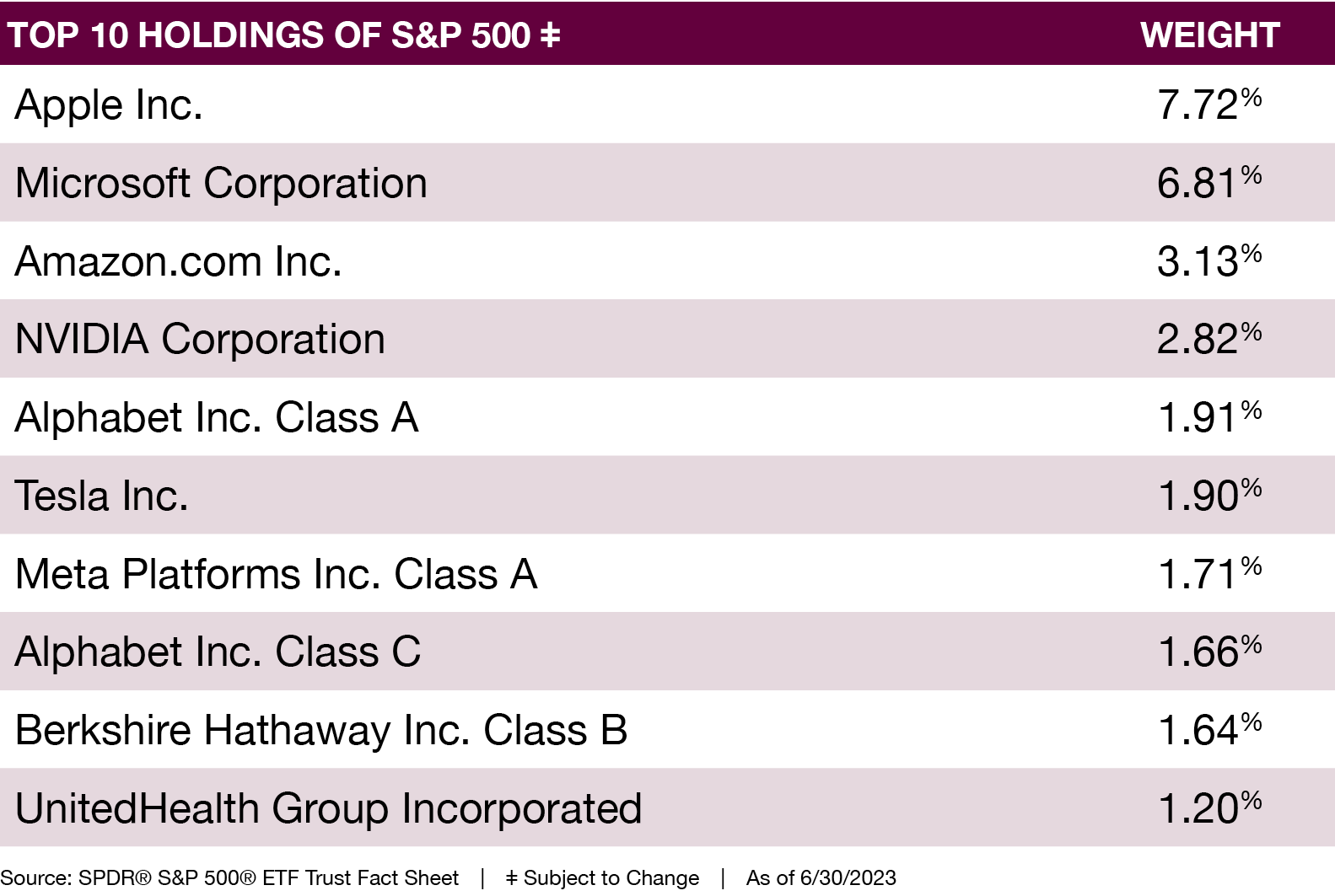

Top 10 Stocks in Control

Historically, the top 10 companies have made up a larger portion of the S&P 500, averaging between 15% to 25% over the past few decades. That total has reached new highs in the past few years with several large technology companies taking off and surpassing over $1 trillion in value. As of the end of August, the top 10 stocks in the S&P 500 are 32% of the index! The S&P 500 is especially concentrated in Apple and Microsoft, making up almost 15% of the index. (See the chart “Top 10 Holdings of S&P 500” below.)

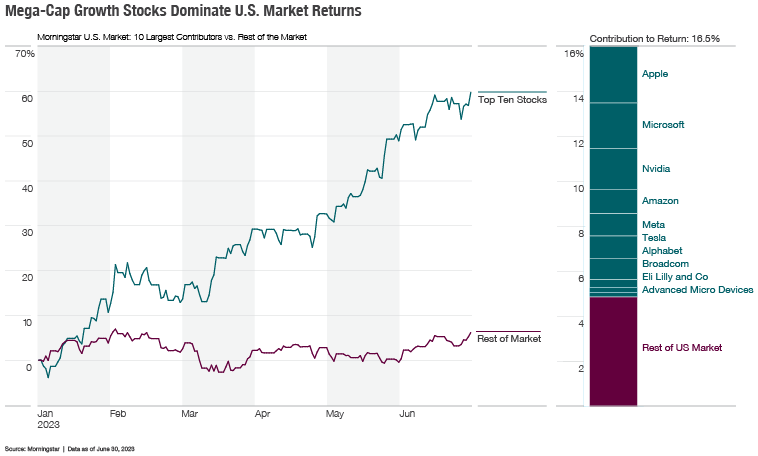

Stock performance this year has added another layer of complexity to S&P 500 market concentration. Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla are the largest holdings in the S&P 500 and the largest contributors to positive performance this year.

Part of that makes sense. Because they are a larger portion of the S&P 500, their positive performance would affect total market performance more than a smaller constituent’s would. However, as of the end of June, these seven companies, along with three other companies (Broadcom, Eli Lilly, and AMD), were responsible for about 70% of the positive performance this year. If someone had created a market-cap-weighted portfolio of these 10 stocks, it would have returned 60% through June! (See the chart “Mega-Cap Growth Stocks Dominate U.S. Market Returns” below, and see the chart “Weight of the top 10 stocks in the S&P 500” below.)

Tech’s Growth Potential

So, what does this mean for the market and your portfolio? One question is: How long can these large technology companies’ outperformance continue? Apple became a $1 trillion company in 2018 and broke $2 trillion in 2020. By itself, Apple is worth more than all the small-cap companies in the Russell 2000 Index. In the last five years, Microsoft also reached $1 trillion and $2 trillion in value.

Can these firms keep up this pace? I think it is possible, and they have an excellent catalyst for growth: artificial intelligence. Goldman Sachs economists believe AI could potentially drive $7 trillion in global economic growth over 10 years, and AI software has a total addressable market of about $150 billion. For more on AI, I highly recommend reading my colleague Garrett Guinn’s article from last quarter, “AI: The Next Revolution?”

Growths Vs. Risks

While there is a significant catalyst for growth for these companies, there are also headwinds, one of the biggest being the current level of interest rates. Growth-focused companies tend to have higher P/E valuations and are more sensitive to increases in interest rates. Investors also have more options for where to invest, especially investors who prefer to take less risk.

Investors also need to remember that since the positive performance of these mega-technology companies had such an enormous impact on the performance of the S&P 500, there is the risk that any negative performance would also carry that weight.

… since the positive performance of these mega-technology companies had such an enormous impact on the performance of the S&P 500, there is the risk that any negative performance would also carry that weight.

Importance of Active Management

Another result of the current market performance is most active managers are lagging the S&P 500 this year. This is especially true when you consider that a well-diversified portfolio also includes holdings in U.S. mid-cap, U.S. small-cap, and international stocks, which all have booked positive returns for this year but are lagging behind the S&P 500.

An additional issue that arises is most investors are attracted to passive investments because they help with diversification, but we are to the point where solely investing in the index can actually hinder diversification. This is where active management can add value, even in years of underperformance.

Active management can create a more diverse portfolio when the market only rewards a few companies. Active management also allows investors to take advantage of times like these where some stocks are performing better than others, both by adding more exposure to those stocks if it is warranted and, conversely, buying companies who have underperformed but have great potential.

Looking to the Future

It has been a much better year for stocks than most investors expected New Year’s Day 2023. The competing forces of innovation and quantitative tightening have been at the forefront, and there is still much of the story that needs to play out. No matter how many people on the internet may claim that they can predict the future and know which 10 stocks will outperform everything else, there is no one out there who only picks winners and never picks laggards.

These 10 companies have performed well this year, but there are hundreds of other companies out there that have potential as well. The good news is, many of them are on sale when compared to this year’s leaders.

REBECCA MITCHELL, CFA

Vice President

(918) 744-0553

RMitchell@TrustOk.com