The Fed’s War on Inflation

Is an economic “soft landing” possible with historically high inflation?

With the invasion of Ukraine in February, Russian President Vladimir Putin has rewritten the European order established at the end of the Cold War. His actions have resulted in thousands of casualties and millions of displaced Ukrainians.

As the conflict settles in and appears that it will persist, world financial and commodity markets have begun adjusting to these events. Since the beginning of the year, U.S. stocks experienced a 10% correction, with most of that decline occurring prior to the invasion. At one point in March, the S&P 500 had experienced the fourth-worst start to a calendar year in its history.

The situation in Ukraine is certainly worth following for many reasons, including both its humanitarian cost and its geopolitical ramifications. But from a market perspective, it is unlikely to be the primary determinant of market outcomes for 2022. Instead, the greater story for the remainder of the year will be historically high inflation and the Federal Reserve’s response.

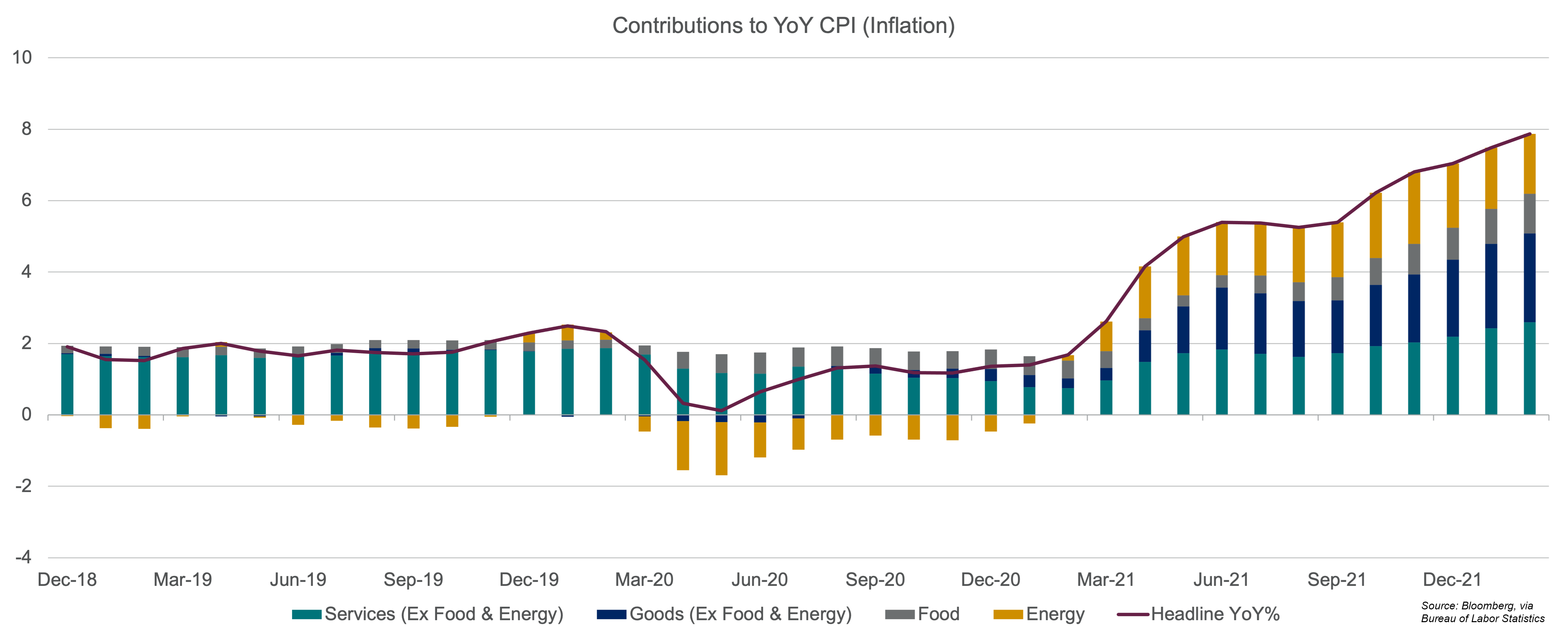

Sources of Inflation

There are many contributors to today’s inflation, but one of the most pronounced has been in the energy sector. In this instance, the conflict in Ukraine has contributed to rising global energy costs. Many countries in Europe rely on natural gas from Russia, and natural gas prices have increased in anticipation of these supplies being taken off the market through sanctions and the development of new wells. Much of Europe’s gas actually travels from Russia through Ukraine, and this has added to the uncertainty surrounding the state of the European energy markets.

Both West Texas Intermediate (WTI) and Brent crude have seen increases of approximately 50% so far this year. This has resulted in much higher gas prices here in the U.S., with the national average price for a gallon of unleaded fuel rising by similar percentages. While higher energy prices are beneficial to many here in Oklahoma, other parts of the country only feel the bite of higher gas prices without the economic benefits that we experience here at home.

Another driver of today’s inflation is wage growth. Currently, the ratio of unemployed persons per job opening is about 0.6. There are over 11 million job openings in the U.S. and about 6.2 million people who are unemployed. In other words, if each and every unemployed person in the U.S. accepted a job, there would still be nearly 5 million open positions. Looking at those numbers it is easy to see why employers are increasing wages to attract new employees.

Undoubtedly, this labor market has been beneficial to employees, providing them with bargaining power over their employers. However, the corresponding increase in wages is not necessarily good news for everyone. For starters, not all industries have benefited from these wage increases equally. Compensation in some industries, such as retail and leisure and hospitality, have increased at a much greater rate than in others, such as construction or manufacturing. Furthermore, wages tend to produce a particularly “sticky” form of inflation. When unemployment eventually increases, wages will likely remain the same or slowly increase, rather than decline in response to changing economic conditions. Put simply, higher wages are likely here to stay.

In addition to wage and energy inflation, lingering pandemic supply chain issues have also produced price increases. In particular, shortages of semiconductors have continued to cause many global supply chain problems. Much of the global supply of these computer chips originates from countries that have experienced strict COVID lockdowns, which has limited the ability of manufacturers to meet surging demand.

Although the semiconductor shortage has constrained the production of many consumer goods, it has had an especially outsized impact on automobile production. Modern vehicles contain over 3,000 chips, controlling parts including the engine and blind-spot detection. Without semiconductors, there is little auto manufacturers can do to increase the supply of new vehicles other than wait for these supply chain constraints to ease.

As anyone who has read or watched the news knows, home prices are also increasing dramatically. According to the Federal Reserve Bank of St. Louis, the median price of a home has increased an astounding 25% over the past two years. Higher home prices have in turn produced similar increases in rental costs, especially as more potential home buyers become priced out of the housing market and become renters instead.

Interestingly, due to nuances in how the government calculates inflation, increases in home prices have not been fully incorporated into official inflation numbers yet. The government’s official inflation calculation requires that these price increases be amortized over 24 months. As a result, much of the increase in rent and housing prices has not been reflected yet in the official government statistics. If housing inflation were immediately accounted for the same as other input prices, current inflation would actually be much worse than reported.

The Fed’s Offensive Playbook

In response to this historically high inflation, the Federal Reserve has finally begun to raise short-term interest rates. At its March meeting, the Fed raised its target for the Fed Funds discount rate by 0.25 percentage points, bringing its stated target to a range of 0.25% to 0.50%. Furthermore, the Fed also indicated that they intend to increase rates six more times during 2022, effectively raising rates each time they meet for the remainder of the year. If they follow through with this plan, the discount rate would increase by an additional 1.5 percentage points from now until the end of the year.

The Fed also announced that it expects to reduce its bond holdings at future meetings. This tactic, dubbed “quantitative easing,” has been used for several years to provide liquidity and price support in the bond market and has been an important tool in keeping interest rates low here in the U.S. The Fed currently holds over $8 trillion in bonds, including Treasuries, agency debt, and mortgage-backed securities. While this has been beneficial in keeping the plumbing of U.S. financial markets working correctly, reversing this and selling bonds back to the market will have the effect of adding additional upward pressure on interest rates.

Chairman Jerome Powell and the Fed’s Board of Governors certainly have ample justification for their proposed actions. In its last announcement, the Fed acknowledged that it no longer considers inflation “transitory,” the term originally used to indicate that it was expected to be temporary. For several months now, inflation has greatly exceeded the Fed’s long-term inflation target of 2%. The other principal objective of the Fed is to maintain maximum employment, which by most definitions has been achieved given the aforementioned surplus of job openings compared to job seekers.

Despite the obvious need for some action on the part of the Fed, the current situation is fraught with risk. Should the Fed raise rates too aggressively, they could stall consumer demand too abruptly and effectively send our economy into recession. Should the Fed raise rates too conservatively, inflation could persist for years.

Ultimately, the Fed will try to engineer a “soft landing,” meaning a reduction in inflation that avoids tipping the economy into recession. This has been extremely difficult for past Federal Reserve chairs to pull off, but the Fed’s March statement emphasized that it will “continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Reassessing 2022’s Outlook

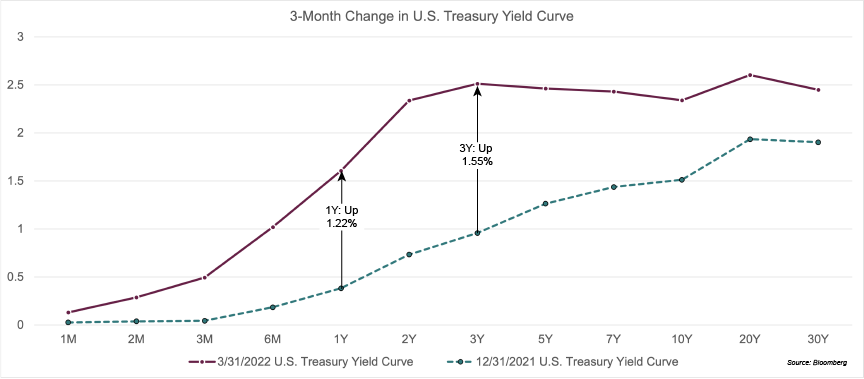

The bond market has already begun to adjust to the Fed’s announced tactics. The yield on the 10-year U.S. Treasury bond has increased from 1.51% at the end of 2021 to 2.34% at the end of March. Thirty-year fixed-rate mortgages have climbed above 4%. However, despite the fact that rates on most portions of the yield curve have risen significantly, the yield on the

30-year U.S. Treasury bond has only increased slightly (see chart below).

In other words, yields on midterm treasuries such as a five-year U.S. Treasury now pay nearly the same interest as a 30-year U.S. Treasury. At the end of March, key rates in the market moved such that the two-year Treasury has a higher yield than the 10-year Treasury, producing an inverted yield curve. Longer-term debt generally pays more in interest than shorter-term, but when that flips and near-term debt pays more interest, it is a warning signal for the economy. It is worth noting that each recent recession has been preceded by a yield curve inversion. However, not every yield curve inversion has resulted in a recession.

While many of these factors could turn out to be negative for the markets, there are some positives to consider. Job growth in the U.S. has been very strong, with the unemployment rate falling to 3.6% as the economy rebounds from the pandemic. Workers have benefited from wage increases as employers adjust to the tightness of the labor market. Many consumers have also seen their net worth increase as housing prices and stock prices climbed strongly during 2021, with corresponding increases in consumer spending and retail sales.

Corporate profits, which bounced back dramatically from the recession of 2020, continue to grow at a healthy clip. Earnings per share for the S&P 500 are currently predicted to grow by about 9% in 2022, and 10% in 2023 (both numbers are year-over-year). Although the U.S. stock market experienced a correction (defined as a decline of 10% or more) in early 2022, longer-term returns have still been very strong. As of Dec. 31, 2021, the S&P 500 had returned an average of over 16% per year for the last 10 years.

Put simply, the past decade has been a phenomenal time to be invested in stocks. While we do not expect returns for the next 10 years to be as strong, we do believe that stocks will provide growth in portfolios over the decade to come.

Higher interest rates will also eventually provide better yields for investors and savers. Money market funds have had virtually no yield for the past two years. If the Federal Reserve raises rates as much as it has indicated, then cash balances in investment accounts could be earning much better interest by the end of 2022.

Your Port in the Storm

As we go forward into the rest of 2022, please be assured that we are paying attention to the markets and working to help our clients preserve and grow their wealth. We greatly appreciate the trust that our clients have placed in us. We wish everyone a peaceful and prosperous remainder of the year.

JAMES SAVAGE, CFA

Senior Vice President

(918) 744-0553

JSavage@TrustOk.com