Collecting Spousal Social Security Benefits

Even if you’ve never contributed to Social Security, you can receive retirement benefits on your spouse’s benefits.

Do I qualify?

You qualify if you are at least 62 years old and your spouse is receiving retirement or disability benefits.

Divorced spouses also qualify to receive benefits on spouse’s record.

How Much Will I Receive?

The spousal Social Security benefit is based on your spouse’s earnings record.

You are entitled to receive the higher of:

- Your own retirement benefit based on your work history

Or

- 50% of your spouse’s Full Retirement Age (FRA) retirement benefit

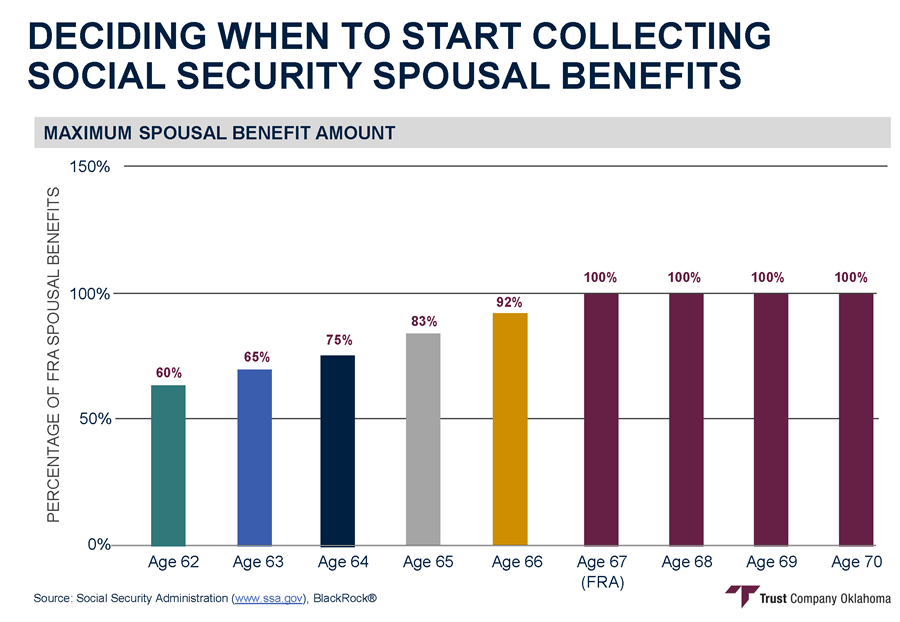

You will receive a lower spousal benefit if you claim before your FRA. You will not receive a higher spousal benefit for claiming past your FRA.

The image below shows what percent of your spouse’s benefit you will receive if you begin collecting it before your FRA (age 67).

At Trust Company of Oklahoma, we strive to help individuals, families, and organizations achieve financial peace of mind. Social Security benefits are an important component to a successful retirement, so make sure you have the information you need to make informed decisions.

Let us know if we can help you plan for a successful retirement without facing the risk of financial insecurity.