Financial Parenting: Teaching Your Kids Financial Responsibility

By Robert A. McCormick

Folks,

Did you receive any financial advice from your parents or grandparents that you would not automatically pass along to your children or grandchildren?

An article titled “Why Your Parents’ Financial Advice Might Be Wrong (Sort of…..)” caused me to reflect on the advice Julia and I delivered to our three children and whether any of it is showing its age.

I decided to go beyond our own household, and I surveyed colleagues to ask what advice they received that they would not share with their offspring. Here are some of the responses I heard, along with why they viewed the advice as questionable today.

- Stay out of debt. And if you take out a mortgage, you should pay it off as quickly as possible. This advice may be questionable because…millennials don’t necessarily have the flexibility to pay off all debt quickly, and given very low interest rates, some thought borrowing made complete sense. Plus, paying off debt too fast could result in not fully funding a retirement plan, which was considered a much more important priority. For the record, this “questionable” advice didn’t come from baby boomers but from the boomers’ parents.

- Stop paying rent and buy a house as soon as possible. This advice may be questionable because…the meltdown of 2008 showed young people that home ownership is not a guarantee for building wealth. Homebuyers could face severe consequences in a downturn, especially if they bought too much house and are highly leveraged to boot. Plus, in some parts of the country, home prices are ridiculously high compared to incomes.

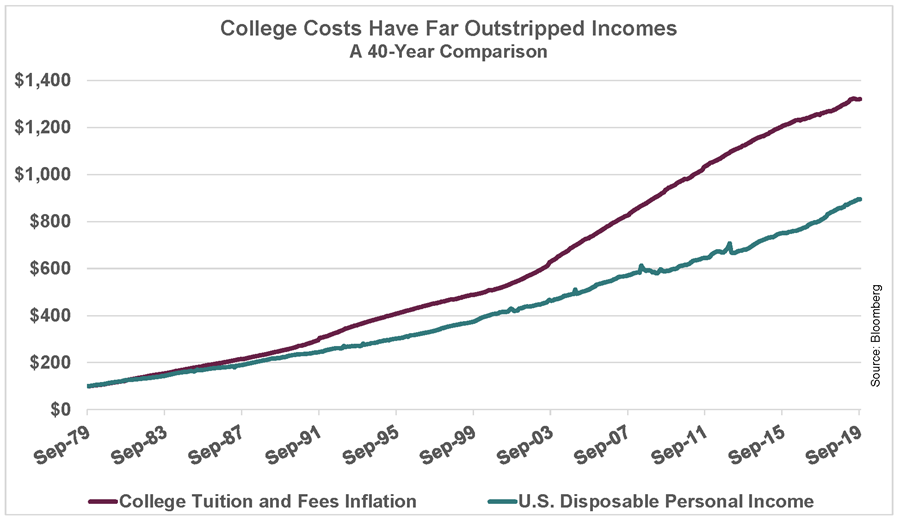

- College is so important, don’t hesitate to borrow if needed. This advice may be questionable because… there are colleges and degrees that do not provide much value. While college-educated people generally earn more than individuals without a degree, it is not guaranteed. And the debt load can be crushing for young people entering the workforce. Students should have a realistic expectation of what the return on debt-funded education will be. See the graphic below showing how college inflation (tuition and fees) has far outpaced disposable personal income over time.

- Live beyond your means, even using credit card debt if necessary. This advice may be questionable because… ok, to be accurate, this was not parental advice, but an example that was set in the household. No explanation is needed to say why this was, is, and will always be a bad example. The rule to follow is to live below your means.

Notice how every single one of these answers revolves around taking on debt. The lesson in #1 is some debt is unavoidable and a reasonable option, especially when you have other important goals such as funding retirement. The lesson in #2 is too much debt is a disaster. Also, a personal residence is not necessarily a smart investment. The lesson in #3 is not all debt is equal in value and the very high cost of higher education can make student loan debt a risky decision. All seem like reasonable conclusions to me.

Lastly, here is one of the more common responses given:

My parents did not give me financial advice; I had to learn it on my own as an adult. Financial advice is often not discussed at home and too rarely taught in school. If you are in this boat, we have good, easy to understand material you can share with your children and grandchildren. We are always happy to visit with your family and share our expertise – and hard-earned lessons.

The article referenced at the beginning of this note also implied that shooting for the corner office was common advice in past days. I disagree with this assertion. Climbing the corporate ladder is not something Julia and I ever heard from our parents, nor did we ever say it to our own children. The advice received from our parents and given to our children: pursue your own dreams, but do so responsibly.

Cheers,

Bob

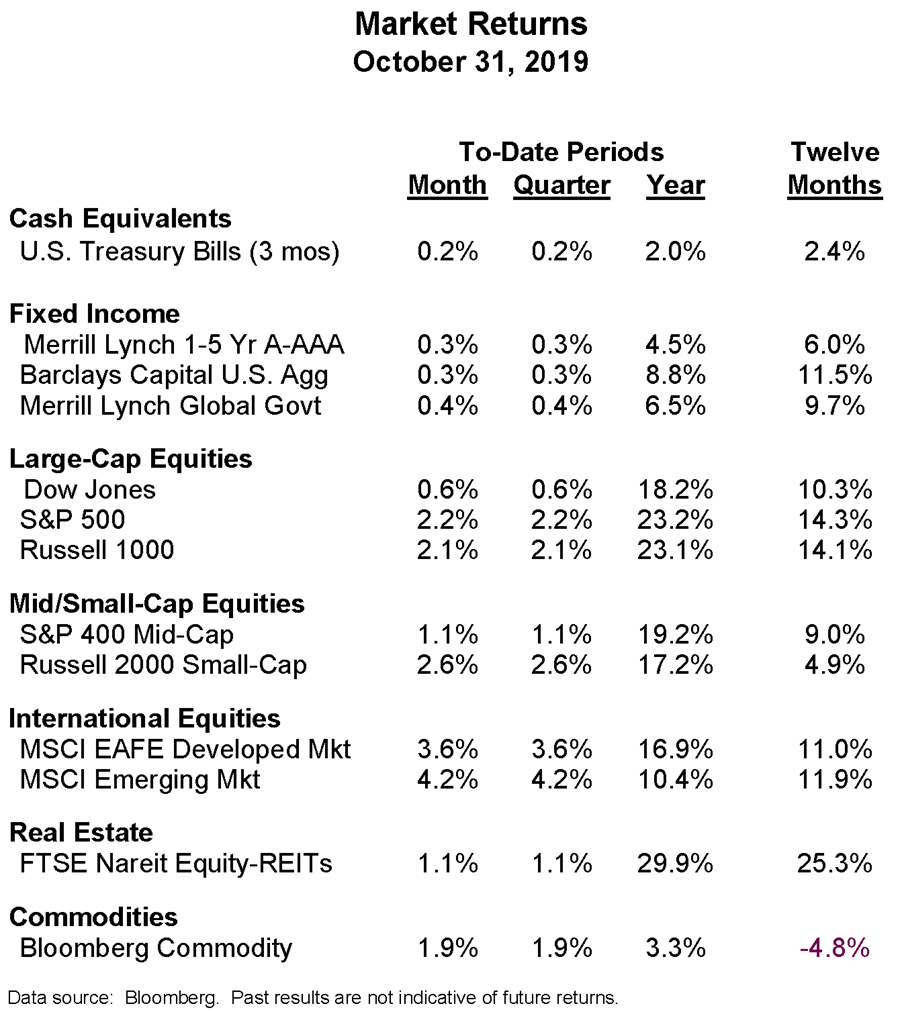

Market Returns

The month of October was filled with negative headlines. Yet, the stock market had a strong month. Large-cap stocks (S&P 500) returned 2.2% and small-cap stocks (Russell 2000) returned 2.6%.

International stocks posted even stronger returns, with developed markets (EAFE) returning 3.6% and emerging markets up 4.2%.

The Fed lowered short-term rates on October 30th – the third time in as many months. Most other interest rates have also fallen in 2019, pushing bond prices up. In aggregate, yields for taxable U.S. bonds are currently in the 2.0 – 2.25% range, which is a reasonable estimate of annual bond returns going forward assuming no change in interest rates.

Robert A. McCormick, CFA, CAIA

Senior Executive Vice President & COO

(918) 744-0553