Unraveling Biden’s Tax Plan

Revenue Proposal Could Affect Income, Capital Gains, and Estate Tax Rates

By Bri Ghosn, CPA, CFP®, CDFA®

As a kid, I loved creating wish lists. Perhaps not all my wish list items were realistic, but what kid doesn’t want a pet tiger? President Joe Biden recently released his American Families Plan revenue proposal, which is essentially his tax policy wish list. This request might never become law, but it provides a road map for tax changes that might be enacted by Congress. The overall proposal is expansive, but let’s dive into a few key pieces.

TAX RATE CHANGES

The tax cuts passed in 2017 lowered the top ordinary income tax bracket from 39.6% to 37%. Biden’s proposal would restore the 39.6% top tax rate for married taxpayers filing jointly with taxable income over $509,300 and for single filers over $452,700.

Additionally, the plan would tax long-term capital gains and qualified dividends at ordinary income tax rates of 39.6%, when total taxable income exceeds $1 million. Under current law, individuals earning over $445,851 per year are only subject to an effective long-term capital gains rate of 23.8%.

Most of the proposals include an effective date of Jan. 1, 2022, but interestingly the capital gains rate increase would have a retroactive effective date of April 2021. Notably, no prior tax increase enacted by Congress has been retroactive. This fact, combined with the reality of the political climate, suggests the most likely effective date for any proposals passing Congress would be Jan. 1, 2022, including capital gains rate changes.

CAPITAL GAINS TREATMENT FOR GIFTING

Currently, gifting appreciated assets does not trigger the recognition of capital gains. Instead, the giver’s basis carries over to the receiver. For example, if you give your daughter XYZ stock currently worth $1,100 and your adjusted basis is $500, she does not pay capital gains tax at the time of the gift. Rather, your basis of $500 carries over to your daughter. If she later sells the stock for $1,300, she would recognize a capital gain for the difference of $800.

The proposal would reclassify gifting as a trigger for recognition of capital gains. Under this change, in the same example as above, you would recognize a $600 capital gain at the time of the gift, and your daughter’s basis in the stock would be $1,100. If she later sells the stock for $1,300, she would only recognize a capital gain of $200.

Likewise, the proposal would reclassify in-kind distributions from irrevocable trusts and partnerships as similar triggers for capital gains recognition. However, the proposal would delay capital gains recognition on the gifting of family-owned and -operated business interests, including farms, until the business is sold or ceases to be family-owned and -operated.

CAPITAL GAINS TREATMENT FOR ESTATES AND THE END OF FREE STEP-UP IN BASIS

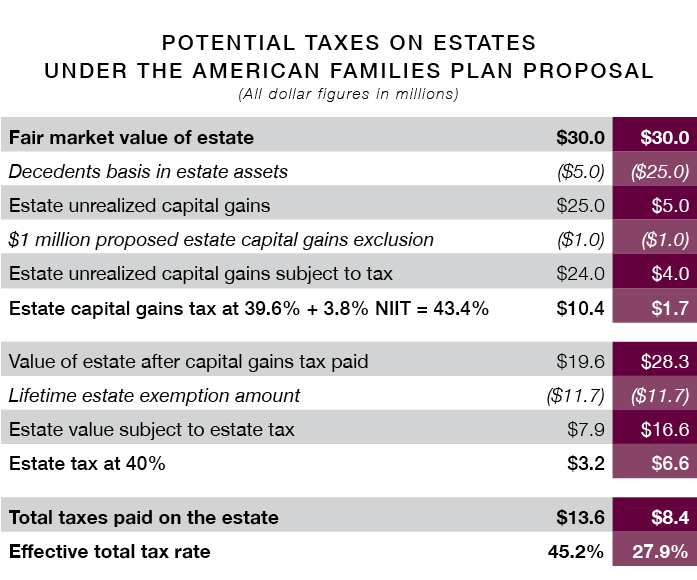

Currently, if an estate’s fair market value exceeds the individual’s lifetime exemption amount ($11.7 million per person for 2021), then the estate pays 40% estate tax on the value exceeding the exemption amount. However, the heirs’ basis in the assets they receive are given a free “step-up” in basis to the fair market value of the assets as of the date of the decedent’s death. It is a free “step-up,” because the unrealized capital gains are erased and never subject to capital gains income tax.

The proposal would not erase those capital gains. Instead, the estate would pay capital gains income tax on all unrealized gains at the decedent’s death, potentially at the proposed increased rate of 39.6%, along with the existing Net Investment Income Tax (NIIT) of 3.8%. Additionally, the estate would still be subject to the 40% estate tax on any value exceeding the decedent’s lifetime exemption amount. The heirs’ basis in assets received would still “step-up” to the date of death value, but it would come at the cost of the estate paying capital gains taxes on the appreciation.

To slightly soften the blow, each individual would receive a new $1 million lifetime exemption, or $2.5 million per couple, for capital gains triggered by gifting or by death. Additionally, any capital gains tax paid by the estate would lower the overall estate value subject to the 40% estate tax.

The higher the unrealized gains in the estate, the higher the potential effective total tax rate charged to the estate. See the chart below for examples.

ITEMS NOT INCLUDED

During his campaign, Biden discussed many potential tax reforms that were not included in this current proposal. Some of the more notable items omitted include:

- Lifetime Exemption Amount: Biden spoke of reducing the lifetime estate and gifting exemption limits to “historic norms.” However, his proposal contains no changes to the current $11.7 million lifetime exemption.

- Qualified Business Income (QBI) Deduction: On the campaign trail, Biden proposed eliminating the QBI deduction, which allows various “pass-through” business owners to deduct 20% of their business income. This deduction would remain completely intact under the proposal.

The American Families Plan proposal will lead to negotiations in Congress and will likely produce a smaller tax increase than the proposed amount, if anything at all. Given the uncertainty, preparation is wiser than making predictions, especially when politics are involved.

We will have to wait and see which of Biden’s wish list of tax changes come to fruition. Just like the items on my childhood wish list, some of the tigers included in Biden’s list may morph into house cats by the time new legislation passes Congress, but only time will tell.

BRI GHOSN, CPA, CFP®, CDFA®

Vice President & Controller

(918) 744-0553

BGhosn@TrustOk.com