Midterm Market Impact

How the upcoming elections could be affecting U.S. stock markets

This year has certainly been challenging for investors. Supply chain complications resulting from the continuing COVID-19 pandemic, the highest inflation rates in more than 40 years, and Russia’s invasion of Ukraine have contributed to sharp declines in both the stock and bond markets.

There is, however, another variable worth considering. For investors familiar with the four-year presidential election cycle, the present direction of the stock market may not be totally unexpected. After all, 2022 is a midterm election year, and data going back more than a century show that midterm election years have generally been the weakest for the stock market in a presidential term.

For example, the market experienced strong gains early in President Trump’s term in office, but in 2018 — the midterm year — at one point the S&P 500 declined by more than 18%. Similarly, stocks had strong gains early in President Biden’s term, only to decline more than 23% at its trough so far this year.

Midterm election years underperform all others in presidential terms

This difficult pattern isn’t a constant throughout history, but it has occurred quite frequently in presidencies dating back to 1900. After a weak stretch in the midterm year, the stock market has typically rallied. Consider the following data, which are the median annualized returns from 1900 through 2021 as tabulated by Ned Davis Research for the years of a presidential term, using the Dow Jones Industrial Average (which has a longer history than the S&P 500 index):

- 12.7% for year 1, the first year of the presidential term

- 3.1% for year 2, the midterm year

- 14.8% for year 3, the pre-election year

- 7.4% for year 4, the election year

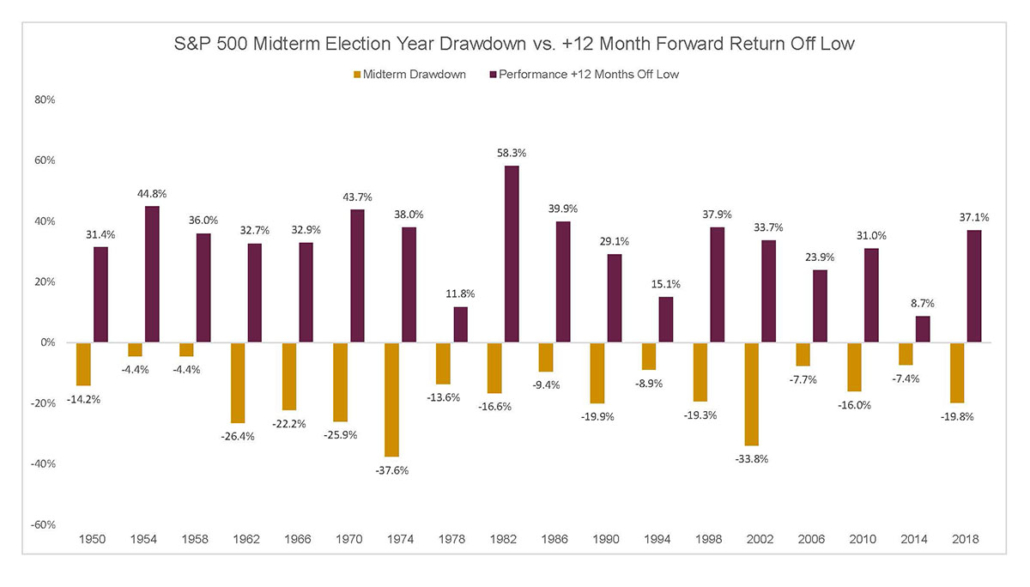

In addition to lower returns, midterm election years are usually the most volatile over the four-year presidential cycle. The higher volatility could be, at least in part, a product of politicians drawing attention to problems facing the country. Campaigns also increasingly employ negative messaging. Those factors, coupled with the fact that markets don’t like uncertainty, have resulted in midterm election years experiencing greater market declines at some point during the year than other years. In fact, since 1950, the average midterm election year correction for the S&P 500 has been 17%, with the other years averaging about a 13% drawdown (as seen in the graph below).

Source: Strategas Research Partners

Market corrections offer buying opportunities

The good news is that these corrections have historically turned out to be great buying opportunities, with stocks up one year from the midterm low every time since 1950, and by an average of 32%. Taking this one step further, the S&P 500 has not declined in the 12 months following a midterm election since 1946, with an average gain of 15% versus an average gain of 7.1% for all other years.

Why this sharp rebound following midterm declines? Perhaps it has something to do with the fact that most presidents suffer major losses in their first midterm election. Following these electoral defeats, equity markets normally begin to price in looser fiscal policy, knowing that presidents want to boost the economy ahead of the next election.

Interestingly, data back to 1982 also reveal that midterm election years have the highest ratio of Federal Reserve rate hikes to rate cuts. Meanwhile, the Fed is historically most accommodative in the year following the midterm election, ahead of the presidential election. Thus, equity markets may also anticipate additional monetary support post-election, boosting equity values. With the Fed poised to raise interest rates at least seven times this year (as of the time of this writing), the potential for this same cycle to play out in the year ahead appears much more likely.

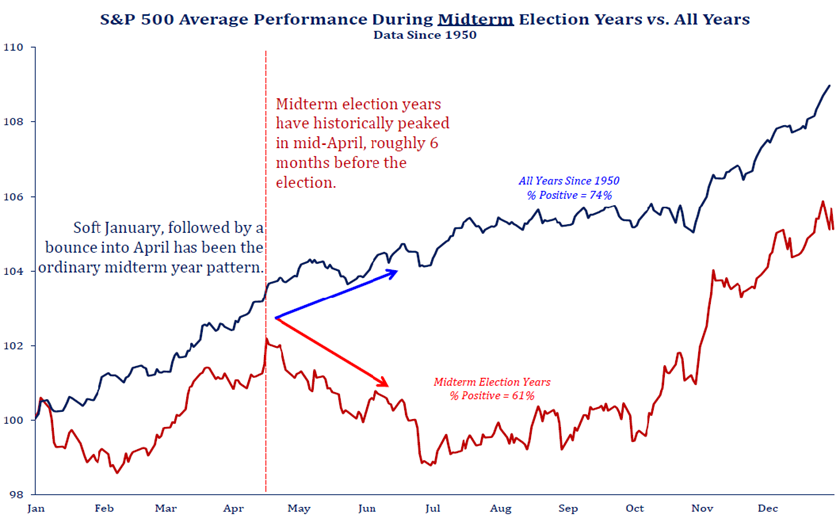

Midterm election years tend to be a grind for U.S. stocks with the S&P 500 historically bottoming in early October, rallying into the election, and then taking off after the election. As such, simply holding the midterm election has been the real catalyst for stocks regardless of which party wins in the election.

Source: Strategas Research Partners

Limitations of midterm market forecasting

It is interesting to review how equity markets have historically fared as both parties vie for additional seats in Congress. However, this information alone does not provide the basis for a strategy for trading in and out of the market. Nor should trading be based on political views or beliefs during a midterm election year, or for that matter, any year.

U.S. midterm election years may have exhibited these trends over long periods of time, but it is important to keep in mind that every individual year is different. Each midterm year is likely to have its own set of circumstances that influence financial markets in addition to the midterm election year factors. For example, in 2022 geopolitics have taken center stage given Russia’s invasion of Ukraine. Furthermore, the Fed is trying to lower inflation substantially from the highest level in more than 40 years. And after unprecedented fiscal policy during COVID-19, budget deficit reduction this year will be the largest since 1947, resulting in less stimulus for the economy.

U.S. midterm elections — and politics as a whole — come with a lot of noise and uncertainty, but ultimately investors shouldn’t let that be a distraction from the fact that long-term equity returns are generated by the value of individual companies over time. The prudent investor should look past the short-term spikes in volatility that elections can bring and maintain a long-term focus.

TIM HOPKINS, CFA

Senior Vice President

(918) 744-0553

THopkins@TrustOk.com